ttkarsenal.ru Market

Market

Mba Opportunity Cost

:max_bytes(150000):strip_icc()/Term-Definitions_Opportunity-cost2-614cfb37567040879073c5ed1d03b25c.png)

The average cost of a competitive MBA program is about $k for 18 months (ignoring opportunity cost). Again, according to GMAC, employers planned to offer a median base salary of $, for new MBA hires in According to the Bureau of Labor Statistics. Opportunity Cost is the value you're giving up when you make a decision. Whenever you invest time, energy or resources in something, you are implicitly choosing. One-Time Costs (Non-Refundable) ; MBA Program Fee, $ ; PreMBA Coursework (MBA Foundations), $ Tuition rates continue to rise for traditional in-person MBA programs, with most U.S. business schools charging between $, and $, for their two-year. More Than $40 Million in New Scholarships ; Application / Transcript Fees, $ ; Other Annual Estimated MBA Costs, $28, ; Living (approx.) $22, ; Books . At its core, opportunity cost represents the value of the foregone alternative when a particular path is chosen. It's a critical concept in decision-making. The average MBA program costs $, but costs vary. Top-tier programs cost around $ a year. In-state and online MBAs can be cheaper options. Depending on what factors are at play, you can expect to pay $40,$, for an MBA degree. However, for many students the higher earning potential, more. The average cost of a competitive MBA program is about $k for 18 months (ignoring opportunity cost). Again, according to GMAC, employers planned to offer a median base salary of $, for new MBA hires in According to the Bureau of Labor Statistics. Opportunity Cost is the value you're giving up when you make a decision. Whenever you invest time, energy or resources in something, you are implicitly choosing. One-Time Costs (Non-Refundable) ; MBA Program Fee, $ ; PreMBA Coursework (MBA Foundations), $ Tuition rates continue to rise for traditional in-person MBA programs, with most U.S. business schools charging between $, and $, for their two-year. More Than $40 Million in New Scholarships ; Application / Transcript Fees, $ ; Other Annual Estimated MBA Costs, $28, ; Living (approx.) $22, ; Books . At its core, opportunity cost represents the value of the foregone alternative when a particular path is chosen. It's a critical concept in decision-making. The average MBA program costs $, but costs vary. Top-tier programs cost around $ a year. In-state and online MBAs can be cheaper options. Depending on what factors are at play, you can expect to pay $40,$, for an MBA degree. However, for many students the higher earning potential, more.

In addition to scholarships, other financial aid opportunities can help reduce the cost of your MBA. Many schools offer grants, assistantships, and work-study. Using business language, these $, are opportunity costs of taking an MBA. So, a two-year MBA program would cost you $, in total costs compared. Tuition Fees: The cost of an MBA program varies depending on the institution, location, and program type. · Opportunity Costs: Pursuing an MBA. MBA full-time model, significantly reduces the opportunity costs of those who forego their current employment to attend. Below is everything you need to. In India, it can cost you anything between lakhs depending on the college. Any top tier(Top) college in India has a fees upwards of The cost of a two-year MBA program varies, however, the estimated total cost for a Wharton MBA is $, Depending on whether you opt for room and board on-. Several factors such as present value of future earnings, cost of pursuing the degree and net present value help us determine rationality of an M.B.A degree. The average cost of a competitive MBA program is about $k for 18 months (ignoring opportunity cost). I had previously written about how. The MBA Program is a full-time, two-year business degree program. Get details, requirements for applying, how to get more information today. On-Campus Program Billed Charges (Direct Costs). Direct costs include tuition cost per credit hour, plus any applicable fees. Curriculum requirements: I am contemplating whether to gain 2 more years of work experience and then pursue an executive MBA program, or if it would be a wise decision. Opportunity cost for pursuing an MBA.: Off Topic. Jul 6 at pm · Jul 6 at pm. I am currently working in strategic marketing, earning 13 LPA with 3. After you factor in living costs, extra-curricular activities, healthcare, and the opportunity cost of taking time out of the workforce for a full-time MBA, the. Already we're in the ballpark of $, US, and we didn't even factor in the opportunity cost of not earning your salary for two years, which. According to CNN Money author David Bogoslaw writing for Fortune, one-year grads tend to come into jobs at the same pay rate as two-years. In some cases, one-. There are many costs involved in getting a Master's in Business Administration ranging from tuition fees to campus living costs to textbook expenses, and MBA. MBA degree doesn't compensate for the expense plus the lost income for two years. They'll use buzzwords like opportunity cost. Ironically, I'm sure my MBA. addition, orthopedic surgeons who were more enthusiastic about their MBA degree may have been more likely to respond to the survey leading to a response. salary you hope to gain from a new job or promotion after graduation vs. the cost in time and money for the degree. Understanding the MBA Degree. MBA. Total Cost of the Full-time MBA program (including Tuition and all Fees) is $52,, $1, per credit hour for Non-OK Residents. *This cost does not.

Where Can I Use A Shell Fuel Card

Shell fuel card locations And if that wasn't enough, Shell fuel cards are also accepted at Shell's partner locations, such as Esso, Texaco, Gulf and Gleaner. Fill out the short form below and we'll be in touch to talk through your requirements and find the right card for you. Once Fuel Rewards® savings have posted to your account, you can redeem them by inserting your Linked Card at any participating Shell station. Void where. Our fleet gas card can be used at any Shell location. We also give you a variety of tools and features to improve your fleet operations. (iv) Wild Cards, which are Cards designated for use with any vehicle by any Authorised. Cardholder. “Card and Service Charges” means the fees or other charges. The Shell Multi card is accepted at over 3, strategically located sites nationwide on the Shell, Esso, Texaco, Gulf, Gleaner, Morrisons and Topaz networks. *. You can use your FRN Card to earn Fuel Rewards savings at any Shell station participating in the Shell Fuel Rewards program. You can also use your FRN Card. The Shell App is designed to help you make the most of your stop! FUELS DRIVERS This mobile payment application provides a secure and convenient way to pay. It's accepted at over 95% of all U.S. fueling stations and 45,+ service locations, and it offers an ongoing rebate schedule for both Shell and non-Shell. Shell fuel card locations And if that wasn't enough, Shell fuel cards are also accepted at Shell's partner locations, such as Esso, Texaco, Gulf and Gleaner. Fill out the short form below and we'll be in touch to talk through your requirements and find the right card for you. Once Fuel Rewards® savings have posted to your account, you can redeem them by inserting your Linked Card at any participating Shell station. Void where. Our fleet gas card can be used at any Shell location. We also give you a variety of tools and features to improve your fleet operations. (iv) Wild Cards, which are Cards designated for use with any vehicle by any Authorised. Cardholder. “Card and Service Charges” means the fees or other charges. The Shell Multi card is accepted at over 3, strategically located sites nationwide on the Shell, Esso, Texaco, Gulf, Gleaner, Morrisons and Topaz networks. *. You can use your FRN Card to earn Fuel Rewards savings at any Shell station participating in the Shell Fuel Rewards program. You can also use your FRN Card. The Shell App is designed to help you make the most of your stop! FUELS DRIVERS This mobile payment application provides a secure and convenient way to pay. It's accepted at over 95% of all U.S. fueling stations and 45,+ service locations, and it offers an ongoing rebate schedule for both Shell and non-Shell.

Shell CRT fuel cards allow you to fill-up your fleet at over Shell stations in the UK. This fuel card is suitable for fleets comprising of HGVs. Manage your Shell credit card account online, any time, using any device. Submit an application for a Shell credit card now. The shell card is chip and pin. You got a weekly/monthly credit limit on the card and on the 1st of every month is when you pay the bill. It's. Features and benefits · Enjoy the convenience of over Shell fuel stations across Malaysia · More than half the stations are open 24/7 · Buy the full range of. Use your Shell Card to pay for ROLA (truck on train) services and bookings on European ferry crossings. By combining driver rest periods with train or ferry. However, with the Fleet Navigator card, it's usable anywhere a MasterCard is accepted. Are the Shell Fuel cards limited to purchasing gas? With regards to the. Valid locations include Shell gasoline stations, Shell convenience stores, and associated car washes. Shell eGift Cards must be added to the Shell App for. Download the Shell App and scan your Shell GO+ Rewards digital card whenever you make a purchase to unlock personalised rewards. Fuel Points are now accepted at select Shell gas stations near you! Use your Shopper's Card to earn Fuel Points redeemable at our fuel centers and these. The Shell Gift Card can be redeemed at the pump or in store, while the Shell eGift Card can be redeemed through the Shell App. With this limited time offer, you get 5¢/gal with Fuel Rewards® Gold Status and 25¢/gal with the Shell | Fuel Rewards® Credit Card for a total of 30¢/gal (up to. Whatever the size of your fleet, from one car to a fleet of HGVs, we have a Shell fuel card that is right for your business. With variable pricing options to. The Shell Hybrid Fuel Card. This card grants unlimited access to an extensive network including Shell, Esso, Texaco, and Gulf fuel stations. This results in a. I don't use much fuel in my business. Is it still worth getting a Shell Card? Yes! Shell Card makes managing your business' fuel easy, whether you have one. This mobile payment application provides a secure and convenient way to pay for fuel at the comfort of your car, as well as purchasing any items inside the. Shell fleet cards help you simplify cashflow, manage payments and reduce fuel costs. The cards are an essential tool for fleets of all types and sizes. Using. SHELL GAS GIFT CARD DETAILS Where can Shell Gift Cards be used? Shell Gift Cards and Shell Refillable Gift Cards can be used at Shell locations throughout the. Why drivers like it. No fuel/vehicle expense reports to file. Accepted at thousands of Shell stations and participating Jiffy Lube® locations nationwide. Shell Card can be used at more than 1, locations across Australia, including around truck-friendly sites. This includes Coles Express, Shell and Liberty.

How To Get Rid Of Your Credit Card Debt

When you owe money on your credit card, the people you owe must follow rules set out by law. Action can be taken against you to collect the debt but you have. Debt consolidation loan. If you have good credit, a debt consolidation loan — like a personal loan or home equity loan — might simplify your debt payoff plan. 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a time. · 4. Consolidate credit card debt. · 5. Consider setting up automatic transfers to your savings account every payday. That way, you can put aside money for your card payments before you have a chance. We understand that these are trying financial times. If you are struggling with credit card debt, we'd like to help. If you are struggling to make your monthly. Calling on a professional is a great way to get advice specific to your financial situation. You can work with a credit counselor—often free through a nonprofit. Pay off high-interest debts first. Using a strategy called the debt avalanche method, you make the minimum payments on all your debts and put extra money toward. 1. Continue to Pay Your Credit Card Bills on Time · 2. Practice Responsible Spending · 3. Choose a Credit Card Payment Strategy · 4. Make Sure You Have an. Use a personal loan to consolidate at a lower interest rate. A debt consolidation loan is a personal loan you use to pay off your existing credit card balances. When you owe money on your credit card, the people you owe must follow rules set out by law. Action can be taken against you to collect the debt but you have. Debt consolidation loan. If you have good credit, a debt consolidation loan — like a personal loan or home equity loan — might simplify your debt payoff plan. 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a time. · 4. Consolidate credit card debt. · 5. Consider setting up automatic transfers to your savings account every payday. That way, you can put aside money for your card payments before you have a chance. We understand that these are trying financial times. If you are struggling with credit card debt, we'd like to help. If you are struggling to make your monthly. Calling on a professional is a great way to get advice specific to your financial situation. You can work with a credit counselor—often free through a nonprofit. Pay off high-interest debts first. Using a strategy called the debt avalanche method, you make the minimum payments on all your debts and put extra money toward. 1. Continue to Pay Your Credit Card Bills on Time · 2. Practice Responsible Spending · 3. Choose a Credit Card Payment Strategy · 4. Make Sure You Have an. Use a personal loan to consolidate at a lower interest rate. A debt consolidation loan is a personal loan you use to pay off your existing credit card balances.

1. Know your budget · 2. Know your debt · 3. Select a credit card debt reduction strategy · 4. Automate your payments · 5. Investigate alternative ways to pay off. Create a Monthly Spending Plan It Will Help You Avoid More Debt To learn how to get out of debt and to stop borrowing from your credit cards again and again. Interestingly, these services are often partly funded by credit card companies. By enrolling in a debt management plan with a credit counseling agency, you may. When you have multiple debts, it is usually advantageous to use the roll-down method instead of the debt-snowball method. By focusing all your extra cash on the. Go to a good local credit union. (I've also heard fidelity can be helpful). Ask them for help consolidating and paying down your credit cards. With this form of credit card debt relief, a financial counselor will meet with you to discuss your circumstance and arrange repayment to each of your creditors. 3. Seek help from credit counseling services. Your credit card company can provide you with many options to resolve your delinquency, including referring you. 5 key strategies to help you get your credit card debt under control · 1. Contact your credit card companies · 2. Understand the two ways to pay off credit card. Start by paying more than the minimum, if you can, while you also work to reduce or eliminate expenses that you typically charge on your card. Build emergency. How can I pay off my credit card debt? · Pay it back gradually · Try to pay at least the minimum payment if you can. · Plan your spending · Make a budget plan. You. Adjust Your Budget; Use a Debt Repayment Strategy; Look for Additional Income; Consider Credit Counseling; Consider Consolidating Your Debt; Don't Forget About. The first step to reducing credit card debt is to identify and eliminate unnecessary expenses, such as entertainment or luxuries. After that, it is important to. #1: Implement a debt reduction plan · #2: Call your creditors to negotiate · #3: Consolidate your debt. Create a Budget. The first step in saying goodbye to credit card debt is to have a plan. · Pay More than the Minimum Payment Amount · Find an Approach That Works. Options for paying off your credit card balance include: · 1. Making a budget · 2. Transfer the balance · 3. Take out a. The first is called the Snowball Method in which you pay off your lowest balances first. The second method is called the Avalanche Method in which you pay off. Make the minimum payment on all your cards to avoid late fees and finance charges. · Pay extra on your credit card with the highest interest rate. · Once that. This means eating out less and cooking more, opting for a Netflix night instead of the movie theater or cutting back on your daily coffee runs. Getting out of. 1. Know your budget · 2. Know your debt · 3. Select a credit card debt reduction strategy · 4. Automate your payments · 5. Investigate alternative ways to pay off. As you eliminate each debt, you free up more money to pay off the next debt. This accelerates repayment until you reach zero on all your balances. This.

How Do You Calculate An Auto Loan Payment

Calculating the cost of an auto loan involves following a mathematical formula. It might not be as simple as 1+2=3, but the concept is the same! Use this calculator to help you determine your monthly car loan payment or your car purchase price. Our free car loan calculator generates a monthly payment amount and total loan cost based on vehicle price, interest rate, down payment and more. Use CarDoor's payment calculator to easily estimate and compare monthly payments on your next vehicle purchase. Divide your interest rate by the number of monthly payments per year. · Multiply the monthly payment by the balance of your loan. · The amount you calculate is. Use our free auto loan calculator to estimate your monthly car payment and what a car loan will really cost you (including interest). To calculate the car payment for your loan, you will need your estimated loan principal, interest rate or annual percentage rate, and loan term. With this. Buying a car? Estimate your vehicle loan payment with this financial calculator from HawaiiUSA Federal Credit Union to see how much you can afford. Try it. How This Auto Loan Calculator Works. Enter the purchase price, monthly payment, down payment, term and interest rate to see how different loan terms or down. Calculating the cost of an auto loan involves following a mathematical formula. It might not be as simple as 1+2=3, but the concept is the same! Use this calculator to help you determine your monthly car loan payment or your car purchase price. Our free car loan calculator generates a monthly payment amount and total loan cost based on vehicle price, interest rate, down payment and more. Use CarDoor's payment calculator to easily estimate and compare monthly payments on your next vehicle purchase. Divide your interest rate by the number of monthly payments per year. · Multiply the monthly payment by the balance of your loan. · The amount you calculate is. Use our free auto loan calculator to estimate your monthly car payment and what a car loan will really cost you (including interest). To calculate the car payment for your loan, you will need your estimated loan principal, interest rate or annual percentage rate, and loan term. With this. Buying a car? Estimate your vehicle loan payment with this financial calculator from HawaiiUSA Federal Credit Union to see how much you can afford. Try it. How This Auto Loan Calculator Works. Enter the purchase price, monthly payment, down payment, term and interest rate to see how different loan terms or down.

Auto Loan Payment Calculator. Change any of the numbers below in order to determine the payment amount (payment changes as you type!). Down Payment: A down payment is the money the buyer pays at the beginning of a vehicle purchase · Loan Term: The time it takes for a loan to be completely paid. Payment Calculator. Calculate the price of a vehicle you could afford by entering a monthly payment and down payment you're comfortable with. Calculation of the car loan amount, simulation of monthly, weekly, bi-monthly payment of your car at a fixed rate according to the number of years. Enter a total loan amount into this auto loan calculator to estimate your monthly payment, or determine your loan amount by car price, trade-in value and other. You can find your total loan payment by figuring out how much you'll pay in interest. Then, add the cost of interest to the principal amount of the loan. Calculating Auto Loan Payments · Use the formula A = P ∗ (r (1 + r) n) / ((1 + r) n − 1) {\displaystyle A=P*(r(1+r)^{n})/((1+r)^{n}-1)} · A = the. Use this calculator to help you understand how all the variables affect your car deal. And be sure to click, call or visit us to apply for your loan. Estimate monthly car payments with an auto loan calculator. Know the auto loan payment & save time at the car dealership. Truliant Credit Union auto loans. Your loan payment should be no more than 15% of your take-home pay. The loan term should ideally be less than 72 months, and you should aim for a down payment. Your monthly payment is based on the net purchase price of the vehicle, the loan term and the interest rate for the loan. The loan amount is based on the net. Determine your monthly auto loan payments or your car purchase price to see what you can afford with the Car Loan Calculator from C&N. Use the "Fixed Payments" tab to calculate the time to pay off a loan with a fixed monthly payment. For more information about or to do calculations specifically. Here's the formula: $3, x = $1, - $ = $ In other words, you may get pre-approved for a monthly car loan payment up to $ based on this. The Auto Loan Calculator from Abound Credit Union allows you to calculate your monthly car loan payments. Take advantage of this car payment estimator. You will divide the interest rate by 12 for the number of monthly payments in a year. Next, you take that answer and multiply it by the balance of your loan. Learn how to calculate auto loan interest using our car loan calculator method. This is a necessary step in determining exactly how much your monthly payment. Estimate your monthly payments with ttkarsenal.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. Use Carvana's auto loan calculator to estimate your monthly payments. See how interest rate, down payment & loan term will impact your monthly payments.

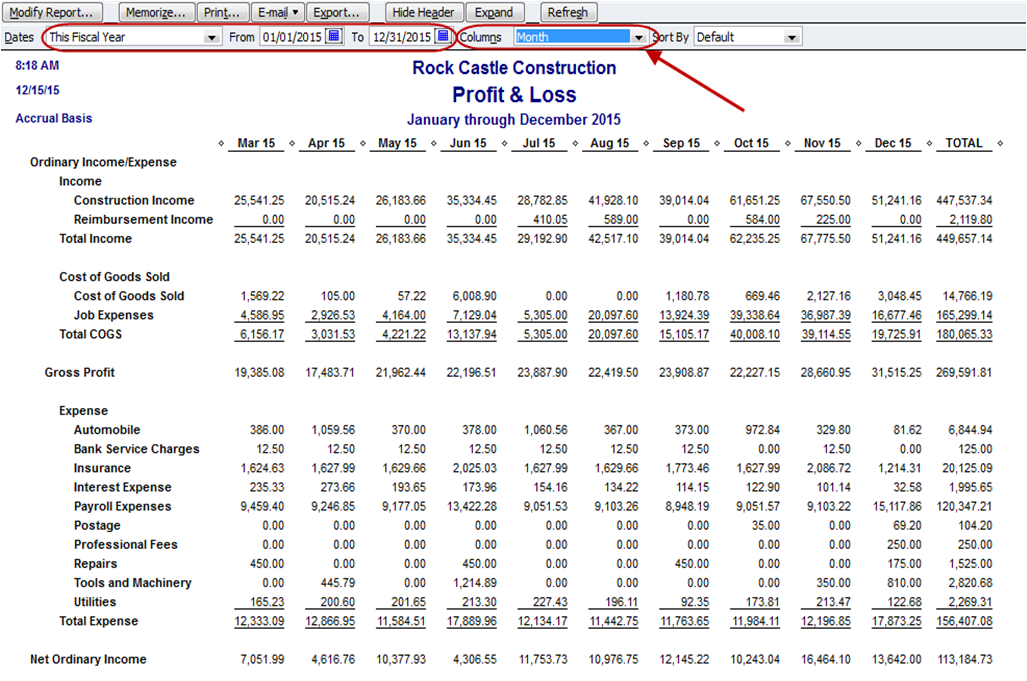

Income Statement In Quickbooks Online

You'll learn how financial statements fit into your year-end procedures in Chapter The profit and loss statement in QuickBooks is formed by using the. The Profit and Loss comparison report in QuickBooks Online allows you to assess how your financial performance has changed over time by comparing P&L reports. The income statement gives you a snapshot view of your business's financial performance and profitability so you can make better financial decisions. 1. Launch QuickBooks and select the "Reports" menu. · 2. Follow the prompts to input the required information for the report. · 3. Create the look for the report. Accounts feed into one of two QuickBooks Online financial reports, either Balance Sheet or Profit & Loss. These are reports that the site can generate. Sign in now for personalized help · Income and expense transactions missing from the Profit and Loss report in QuickBooks Online · Impacts of inventory tracking. Find out why your Profit and Loss report is missing income and expense transactions in QuickBooks Online. In a nutshell, financial reports show how your. To navigate to the Profit and Loss report click Reports in the main top menu. Then select Company & Financial -> Profit & Loss Standard. Step 2: Customize your report · Go to Business overview then select Reports (Take me there), or go to Reports (Take me there). · Open a Profit and Loss Comparison. You'll learn how financial statements fit into your year-end procedures in Chapter The profit and loss statement in QuickBooks is formed by using the. The Profit and Loss comparison report in QuickBooks Online allows you to assess how your financial performance has changed over time by comparing P&L reports. The income statement gives you a snapshot view of your business's financial performance and profitability so you can make better financial decisions. 1. Launch QuickBooks and select the "Reports" menu. · 2. Follow the prompts to input the required information for the report. · 3. Create the look for the report. Accounts feed into one of two QuickBooks Online financial reports, either Balance Sheet or Profit & Loss. These are reports that the site can generate. Sign in now for personalized help · Income and expense transactions missing from the Profit and Loss report in QuickBooks Online · Impacts of inventory tracking. Find out why your Profit and Loss report is missing income and expense transactions in QuickBooks Online. In a nutshell, financial reports show how your. To navigate to the Profit and Loss report click Reports in the main top menu. Then select Company & Financial -> Profit & Loss Standard. Step 2: Customize your report · Go to Business overview then select Reports (Take me there), or go to Reports (Take me there). · Open a Profit and Loss Comparison.

Run the profit and loss report by class. Go to "Reports" and click on the "Company and Financial" tab. From the drop-down list, select the "Profit and Loss by. financial statements, like Profit and Loss or Income Statements. Whether you plan to use QuickBooks Online yourself, have an in-house bookkeeper, or hire a. You can start by logging into your QuickBooks Online account and navigating to the 'Reports' tab. From there, select the 'Profit and Loss' report option. You'll. The report itself is very simple in QuickBooks Desktop. You can easily see your income, expenses and cost of goods sold. One thing the Profit & Loss report is. QuickBooks Online includes a handy profit and loss statement template, which makes it easy to create your own customised statement in just a few clicks. QuickBooks Online AdvancedQuickBooks Online EssentialsQuickBooks Online PlusQuickBooks Online Simple Start. Sign in now for personalized help. Fiverr freelancer will provide Financial Consulting services and do profit and loss, income statement in quickbooks online with bookkeeping within 2 days. It determines whether it is a balance sheet or an income statement account. It determines whether it goes at the top or the bottom of the income statement;. Go to the Reports section in your QuickBooks Online company file. · In the search bar, type in “Custom Summary Report” and tab to let the report process. · At the. The Statement of Cash Flow in QuickBooks provides a comprehensive overview of your company's cash inflows and outflows. You can find financial statements in QuickBooks under the "Reports" section. This section includes the Profit and Loss Statement, Balance Sheet, and Statement. The Statement of Cash Flows is an essential financial document that offers insights into the financial health of a business. QuickBooks Online simplifies the. To navigate to the Profit and Loss report click Reports in the main top menu. Then select Company & Financial -> Profit & Loss Standard. When you run the Profit and Loss Standard report in QuickBooks, you get one column of results. This column could be the figures for. The QuickBooks reporting menu provides several pre-configured reports to help you with the process of creating your profit and loss report, also known as an. Choose a suitable time frame. You can calculate your income statement monthly, quarterly or yearly to ascertain the company financial health. · Then add up. Income Statement - nothing recorded. Balance Sheet A Community of users for Quickbooks Online, Pro, Premiere and Enterprise Solutions. This report summarizes all the income and expenses that have been incurred by a business for a specific period of time. The difference between income and. In QuickBooks, an income and expense report – commonly known as an income statement – is referred to as the Profit and Loss report. From the. An income statement, also known as a P&L (profit and loss statement) or statement of operations, tallies and summarizes revenue earned and expenses incurred in.

Current Car Loan Interest Rates For Good Credit

Good rates are generally under 4%, which is what my parents got. Typical rates are around %, and anything above 10% starts to get on the high. New and Used auto interest rates change over time, but you can access current rates anytime online through UW Credit Union. Check loan rates for Autos. + credit score – You'll qualify for the lowest rates, likely under 6%. credit score – You'll get a good rate, usually around %. Rates may range from % to % for model years and reflects a% discount for automatic payments from a Sikorsky Credit Union account. Auto Loan Rates as Low as %. Start your pre-approval today. Start your pre-approval today. Apply Today. Where are you in. Of course, the lower the rate, the better it is for those who need a car loan. For borrowers with credit scores of and above, the average interest rate for. car loan for a new car for someone with excellent credit is percent Usually, used car loan interest rates are a little higher than the rates for new car. * Rates “as low as” % APR assumes excellent creditworthiness; your rate may differ from the rate(s) shown here. Rate and loan amount subject to credit. The current average APR rate for a person with a credit score when buying a new car is % and when buying a used car. How to Get a Credit Card. Good rates are generally under 4%, which is what my parents got. Typical rates are around %, and anything above 10% starts to get on the high. New and Used auto interest rates change over time, but you can access current rates anytime online through UW Credit Union. Check loan rates for Autos. + credit score – You'll qualify for the lowest rates, likely under 6%. credit score – You'll get a good rate, usually around %. Rates may range from % to % for model years and reflects a% discount for automatic payments from a Sikorsky Credit Union account. Auto Loan Rates as Low as %. Start your pre-approval today. Start your pre-approval today. Apply Today. Where are you in. Of course, the lower the rate, the better it is for those who need a car loan. For borrowers with credit scores of and above, the average interest rate for. car loan for a new car for someone with excellent credit is percent Usually, used car loan interest rates are a little higher than the rates for new car. * Rates “as low as” % APR assumes excellent creditworthiness; your rate may differ from the rate(s) shown here. Rate and loan amount subject to credit. The current average APR rate for a person with a credit score when buying a new car is % and when buying a used car. How to Get a Credit Card.

Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. Car loan APRs range from % APR to % APR when you use Auto Pay. Applicants receive a fast credit decision. Collateral requirements. New or pre-. Refinanced car loan. You could save on interest by refinancing your current auto loan to a lower rate at Alliant. How to get your credit union car loan. You. New & Used Auto Loans ; % - % APR · % - % APR · $ - $ Used car (dealer): Example: A 5-year, fixed-rate used car loan for $32, would have 60 monthly payments of $ each, at an annual percentage rate (APR) of. Finance Your Next Car ; Model Years & Newer Rates as Low as · % APR ; Model Years – Rates as Low as · % APR ; Model Years – Rates as Low. Consumers Credit Union offers auto loan options for new and used vehicles, Rvs, motorcycles, and boats. Find the right financing option for you. The average interest rate for auto loans on new cars is %. The average interest rate on loans for used cars is %. Average interest rates for car loans ; , , , ; New-car loan, %, %, %, %. In mid, the average interest rate on a three-year used car loan from a credit union was %, while the same loan from a bank carried an average rate of. Personal loans and car loans are both options when purchasing a vehicle, but car loans are usually the better choice because they tend to be less expensive. Car. Credit score range. Average interest rate ; to % ; to % ; to % ; to %. Typically, the higher your credit score, the lower your interest rate will be. That's because a high credit score indicates that you have a good history of. Consumers Credit Union offers auto loan options for new and used vehicles, Rvs, motorcycles, and boats. Find the right financing option for you. Average Used Auto Loan Rate for Excellent Credit. Credit Score, Interest Rate. or higher, %. Average is currently %. % is only eligible for people with excellent credit. Either way, it makes buying any car unaffordable for now. Auto Loan Rates (used) ; Months, %% ; Months, %% ; Months, %% ; Months, %%. 7-year auto loans, rates as low as % APR, Star One Credit Union. What is the difference between new and used car interest rates? Even with an excellent credit score, car loan rates for used vehicles may be higher due to. Auto Loan Rates ; & Newer Vehicle Rates · 1 · % · $ per $1, · % ; Vehicle Rates · 2 · % · $ per $1, · % ; & Older.