ttkarsenal.ru Overview

Overview

Best Safe Return On Investment

A good return on investment is about 7% per year, based on the historic return of the S&P index, adjusting for inflation. But investors have to weigh. They offer stable returns, which are typically the guaranteed return on the investment. These types of investments are suitable for risk-averse investors. Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market. Equity investing for a new era: The return of alpha. Portfolio Management Tech was best in Q4 earnings but look to the rest as market broadens. Portfolio. These funds offer a low level of risk because they invest in low-risk investments like government-backed securities. You can use a money market fund to save for. For someone who wants to take a "high-risk flyer" (an investment in a theatrical production, for example), it means you should confine it to the top of the. By investing in more than one asset category, you'll reduce the risk that you'll lose money and your portfolio's overall investment returns will have a smoother. The interest rate on savings generally is lower compared with investments. While safe, savings are not risk-free: the risk is that the low interest rate you. Mutual funds is the best safest and good returns with minimum risk investment option. It gives nearby 18% to 20% returns every year. Bonds are. A good return on investment is about 7% per year, based on the historic return of the S&P index, adjusting for inflation. But investors have to weigh. They offer stable returns, which are typically the guaranteed return on the investment. These types of investments are suitable for risk-averse investors. Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market. Equity investing for a new era: The return of alpha. Portfolio Management Tech was best in Q4 earnings but look to the rest as market broadens. Portfolio. These funds offer a low level of risk because they invest in low-risk investments like government-backed securities. You can use a money market fund to save for. For someone who wants to take a "high-risk flyer" (an investment in a theatrical production, for example), it means you should confine it to the top of the. By investing in more than one asset category, you'll reduce the risk that you'll lose money and your portfolio's overall investment returns will have a smoother. The interest rate on savings generally is lower compared with investments. While safe, savings are not risk-free: the risk is that the low interest rate you. Mutual funds is the best safest and good returns with minimum risk investment option. It gives nearby 18% to 20% returns every year. Bonds are.

4. Corporate bonds · Investment-grade corporate bonds are considered less risky because the issuing corporation is less likely to default on its debt. You can choose from a number of different investment options, such as stocks and mutual funds. Some people have a higher risk tolerance and opt for aggressive. Cash and cash equivalents such as certificates of deposit (CDs) or money market funds are among the safest and most liquid of investments. Cash is available. The answer is that 12% is a ridiculous number. But if 12% isn't a reasonable rate of return on the money you invest, then what is? I think you will find that. Safe is cash, like a money market fund. Currently yields like 5%-ish. High is a broad market index fund, should earn 10% per year or so over the long term. Top five detractors - Five assets in a portfolio that generated largest negative returns (losses). Top five holdings - Top five securities in a portfolio based. Where can I get 10 percent return on investment? · 2. Invest in stocks for the short term. · 3. Real estate · 4. Investing in fine art · 5. Starting your own. Fixed income investments generally carry lower risk than stocks. They also function well as a way to generate income or value from your investments on a. To maximize your fund returns, or any investment returns, The broker relies on this information to determine which investments will best meet your investment. Mutual funds is the best safest and good returns with minimum risk investment option. It gives nearby 18% to 20% returns every year. Bonds are. A good place to park your emergency fund is a high-yield savings account. This way, you'll get guaranteed returns in the form of compound interest. Some high-. Some of the safest tax-saving investment options in India include PPF, NSC, 5-year tax-saving fixed deposits, Senior Citizens Savings Scheme (SCSS), and Sukanya. A good return on investment is about 7% per year, based on the historic return of the S&P index, adjusting for inflation. But investors have to weigh. What is a high-risk, high-return investment? · Cryptoassets (also known as cryptos) · Mini-bonds (sometimes called high interest return bonds) · Land banking. Defensive investments ; Investment. Characteristics. Risk, return and investing time frame ; Cash. Includes bank accounts, high interest savings accounts and term. List of Top 15 Safe Investments in India with High Returns · Capital Guarantee Plan · Unit Linked Insurance Plans (ULIPs) · Public Provident Fund (PPF) · Life. “Ideally, you'll invest somewhere around 15%–25% of your post-tax income,” says Mark Henry, founder and CEO at Alloy Wealth Management. “If you need to start. A short-term investment, such as a U.S. Treasury bill or a money market mutual fund, that you can easily convert to cash. HOW YOU EARN RETURNS: Most cash. Unlock investing basics. Learning about financial topics is a great way to gain confidence as you start your investing journey. 10 Best Low-Risk Investments for and Beyond · 1. Money Market Funds · 2. Fixed Annuities · 3. Preferred Stocks · 4. Treasury Notes, Bills, Bonds and TIPS · 5.

Cheapest Bandwidth Hosting

Unlimited Bandwidth VPS Hosting The VPS service is the most logical choice for websites with a large audience. It is much more suitable for popular projects. Therefore, web hosting doesn't result in "bandwidth" costs, but rather data transfer costs. A certain amount of data per time period (typically per month) is. Ionos (previously known as 1&1) has earned a reputation for being a cheap web host with some of the most affordable hosting services around, hands down. It. At the heart of our hosting prowess lies the remarkable bandwidth offerings. The Premium plans set the stage with an enticing GB bandwidth, providing a. € / Mo · 2GB HDD (SAS-RAID) · GB monthly bandwidth · 2x websites · up to 2 domains · unlimited subdomains, emails, aliases, ftps, databases · Virtualmin®. At ONOHOSTING, we offer the most reasonable full-featured shared hosting plan among the top cheap web hosting solutions. It's an excellent choice for all who. What is Cheap VPS with Unlimited Bandwidth? Cheap VPS with Unlimited Bandwidth is a hosting solution that combines affordability with unrestricted data transfer. They also have cheap shared hosting starting at $ a month. For this relatively low price, you'll get hosting for 1 domain, unlimited bandwidth and disk. Hosting Deploy your new VPS Server in a high-speed datacenter in Unlimited Bandwidth Is a Unlimited Bandwidth VPS hosting cheaper than a dedicated server? Unlimited Bandwidth VPS Hosting The VPS service is the most logical choice for websites with a large audience. It is much more suitable for popular projects. Therefore, web hosting doesn't result in "bandwidth" costs, but rather data transfer costs. A certain amount of data per time period (typically per month) is. Ionos (previously known as 1&1) has earned a reputation for being a cheap web host with some of the most affordable hosting services around, hands down. It. At the heart of our hosting prowess lies the remarkable bandwidth offerings. The Premium plans set the stage with an enticing GB bandwidth, providing a. € / Mo · 2GB HDD (SAS-RAID) · GB monthly bandwidth · 2x websites · up to 2 domains · unlimited subdomains, emails, aliases, ftps, databases · Virtualmin®. At ONOHOSTING, we offer the most reasonable full-featured shared hosting plan among the top cheap web hosting solutions. It's an excellent choice for all who. What is Cheap VPS with Unlimited Bandwidth? Cheap VPS with Unlimited Bandwidth is a hosting solution that combines affordability with unrestricted data transfer. They also have cheap shared hosting starting at $ a month. For this relatively low price, you'll get hosting for 1 domain, unlimited bandwidth and disk. Hosting Deploy your new VPS Server in a high-speed datacenter in Unlimited Bandwidth Is a Unlimited Bandwidth VPS hosting cheaper than a dedicated server?

Flywheel. This managed WordPress web host offers 20 GB of bandwidth on its Tiny hosting plan. Cloudways. With Cloudways, bandwidth offerings start at around 2. Host25Cent is a fast and reliable web hosting provider of affordable unlimited web hosting and the cheap web hosting plans. Your website. We host. If you're hosting a site that is hogging much of the bandwidth on a cheapest unlimited hosting plan. In any case, it's always a smart idea to. When you create a free website, Wix gives you free website hosting that includes MB of cloud storage and MB bandwidth. With a Premium Plan, you can. $/mo. Get the good stuff without the premium price. Economy Hosting includes: 1 website, 25 GB storage, unmetered bandwidth, free domain and free email. DreamHost provides its customers with top-of-the-line hosting plans at bargain prices. Regardless of the hosting plan, you can access excellent features. Startup Cloud Hosting Scalable, cost-effective infrastructure Simple, managed Kubernetes built for scale. Free control plane, free bandwidth allowance, and. Our cheap website hosting plan comes with a website builder, 50 GB of SSD, GB of bandwidth, a free SSL certificate, and all the advanced tools you need. Inmotion offers affordable and performance-focused web hosting. Their plans start at $ per month. It includes unlimited bandwidth, free. Inmotion offers affordable and performance-focused web hosting. Their plans start at $ per month. It includes unlimited bandwidth, free. Shared web hosting customers do not need to request more bandwidth since these accounts have unmetered bandwidth. Reseller. Reseller customers can obtain more. Each of the top 5 web hosting providers highlighted in this article—1Byte, Hostinger, Bluehost, InMotion, and SiteGround—offers unique strengths that cater to. Starting price: $/mo. · Renewal price: $/mo. · Negotiable prices: only on renewals · Websites allowed: unlimited · Storage: unlimited · Bandwidth: unlimited. professionals in Europe, the USA. Get unmetered VPS hosting with unlimited bandwidth. Affordable and reliable servers for your growing business needs. Unmetered Bandwidth: QloudHost's VPS hosting plans come with unmetered bandwidth, ensuring consistent performance even during traffic spikes. A2 hosting provides % of uptime, ms load time, free email accounts, included SSL and anytime money-back guarantee. Its cheapest plan starts at $/. Mini Starter · Free Domain · +7 Locations · 10 Domains · 10Gb SSD Storage · Bandwidth · 10 Databases · 10 Emails · 10 FTP. Hostinger's Premium plan, which costs $ a month for a 4-year subscription, comes with unrestricted bandwidth, unmetered storage, and support for unlimited. Free Domain, one click WordPress, free emails, unlimited traffic, generous disk space, Free website builder and unlimited bandwidth. Also included is our.

Easiest Bank To Get A Home Loan With

Getting a Mortgage · Check Your Credit Score. Knowing your credit score before you apply for a mortgage can save you time. · Create a Budget. · Research. Better Mortgage Corporation is a direct lender dedicated to providing a fast, transparent digital mortgage experience backed by superior customer support. Explore the top mortgage lenders and land down payments as low as 0% to 15%. Find the perfect home loan lender with Forbes Advisor. Fifth Third Bank can help you get moving with great rates and a variety of mortgage lending products to fit your needs. Apply Online. Get in Touch. Mortgage made simple. Our goal is to make the mortgage loan process straightforward and easy to navigate. Whether you meet with a mortgage banker face-to-. Do you need mortgage loans at low-interest rates? Explore competitive mortgage interest rates for home loans and get started in applying for a mortgage. Let us help find the home loan that's right for you. Our home loans — and low home loan rates — are designed to meet your specific home financing needs. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. Navy Federal Credit Union – can offer lower mortgage rates and can accept a higher debt-to-income ratio. · Loan Depot – you can get a mortgage preapproval in. Getting a Mortgage · Check Your Credit Score. Knowing your credit score before you apply for a mortgage can save you time. · Create a Budget. · Research. Better Mortgage Corporation is a direct lender dedicated to providing a fast, transparent digital mortgage experience backed by superior customer support. Explore the top mortgage lenders and land down payments as low as 0% to 15%. Find the perfect home loan lender with Forbes Advisor. Fifth Third Bank can help you get moving with great rates and a variety of mortgage lending products to fit your needs. Apply Online. Get in Touch. Mortgage made simple. Our goal is to make the mortgage loan process straightforward and easy to navigate. Whether you meet with a mortgage banker face-to-. Do you need mortgage loans at low-interest rates? Explore competitive mortgage interest rates for home loans and get started in applying for a mortgage. Let us help find the home loan that's right for you. Our home loans — and low home loan rates — are designed to meet your specific home financing needs. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. Navy Federal Credit Union – can offer lower mortgage rates and can accept a higher debt-to-income ratio. · Loan Depot – you can get a mortgage preapproval in.

Shop for a loan, not a lender. You may have a long-term relationship with your bank, but that doesn't mean they will give you the best deal. Most loans are sold. We believe securing a home loan should be easy. Northwest offers a variety Find the right mortgage fit for you in the chart below. Find a mortgage loan. Your USAA loan officer makes the application process easier. Once you find a home, your loan officer will help you complete the mortgage application. You'll. FHA Loans · How much you can borrow, max, on an FHA loan varies by county based on the home prices in your area; limits can change annually with recent ones. Considering buying a home with bad credit? Learn about home loans for bad credit, along with tips for improving your credit score to qualify for a mortgage. GET PREQUALIFIED. Connect Today. Before you even begin, our lenders can pre-qualify you for a home loan. The process is quick and easy, with. get funding by setting guidelines for loans and reducing lender risk. These SBA-backed loans make it easier for small businesses to get the funding they need. Find competitive home loan rates and get the knowledge you need to help you make informed decisions when buying a home. The most common factors that hurt your ability to get a mortgage are: Low credit score; Inadequate income (documented income); Not enough savings; High debt-to-. Compare all mortgage loan options in one easy spot. Focus your home apply for a mortgage loan when you find a home or property you love. How do. Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination fees. · Veterans United. Mortgage broker - shops the market for you with different wholesale lenders. · non-bank lender - like Rocket Mortgage · Bank and credit union -. We bank with Chase but ended up going with a local regional bank. The mortgage process went very smooth and they were easy to communicate with. Eligible applicants may purchase, build, rehabilitate, improve or relocate a dwelling in an eligible rural area with % financing. The program provides a 90%. From home mortgage calculators to resources like our Home Loan Navigator®, we're ready to help you every step of the way – from application to closing. Bank. For most of us, obtaining a mortgage is a crucial step in purchasing a first home. There are a variety of financing options available to first-time. Fill out our simple mortgage application, get personalized rates, and upload your documents. You can even save your progress and come back later. I want to. Home Loan for Regular Purchase. The Department of Veterans Affairs (VA) The Federal Housing Administration (FHA) makes it easier for consumers to obtain. Wells Fargo Home Mortgage offers competitive rates on a variety of home loan options. Visit Wells Fargo today to check rates and get mortgage financing. For over 30 years Churchill Mortgage has been on a mission to lead our clients to the ultimate American dream — debt-free homeownership. We believe debt-free.

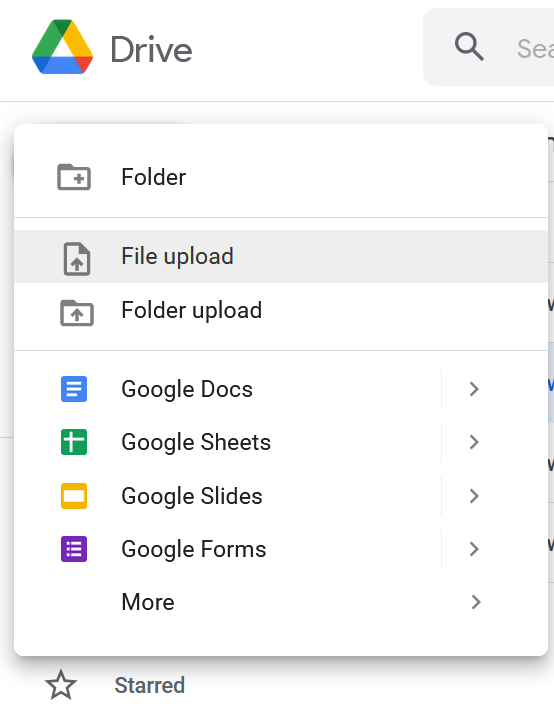

Migrate Files From Google Drive To Onedrive

To transfer from OneDrive to Google Drive without downloading, you can add OneDrive and Google Drive to MutlCloud, then move files between them quickly. SysTools Google Drive to OneDrive Migration Tool allows to migrate Google Drive files to OneDrive for business (Previously known as SkyDrive Pro) account. Transfer files from Google Drive to Onedrive and vice versa. No download and re-upload. MultCloud is a free web-based tool that enables you to easily transfer. In this case, the data can still be accessed in Google Drive or in Microsoft OneDrive. You may have to work in both locations until the migration is complete. Try Gs Richcopy, it will copy your files directly from Googledrive to Onedrive and also supports migrating between other several clouds. Method 1: Manually Download and Upload · Login to Google Drive using credentials and open your Drive. · Select all files which you want to download then click on. How to Transfer Files from Google Drive to Microsoft OneDrive · Step 1: Sign in to Google Drive and locate the files to transfer · Step 2: Download the files. Native G Suite Drive to OneDrive for Business Migration · Sign into your Google account and choose Drive from Google apps. · Download the documents from Google. You can copy or move files/folders directly from OneDrive to Google Drive. Otherwise, you can download the files you need and then upload them to OneDrive. To transfer from OneDrive to Google Drive without downloading, you can add OneDrive and Google Drive to MutlCloud, then move files between them quickly. SysTools Google Drive to OneDrive Migration Tool allows to migrate Google Drive files to OneDrive for business (Previously known as SkyDrive Pro) account. Transfer files from Google Drive to Onedrive and vice versa. No download and re-upload. MultCloud is a free web-based tool that enables you to easily transfer. In this case, the data can still be accessed in Google Drive or in Microsoft OneDrive. You may have to work in both locations until the migration is complete. Try Gs Richcopy, it will copy your files directly from Googledrive to Onedrive and also supports migrating between other several clouds. Method 1: Manually Download and Upload · Login to Google Drive using credentials and open your Drive. · Select all files which you want to download then click on. How to Transfer Files from Google Drive to Microsoft OneDrive · Step 1: Sign in to Google Drive and locate the files to transfer · Step 2: Download the files. Native G Suite Drive to OneDrive for Business Migration · Sign into your Google account and choose Drive from Google apps. · Download the documents from Google. You can copy or move files/folders directly from OneDrive to Google Drive. Otherwise, you can download the files you need and then upload them to OneDrive.

In this article, you will learn the step-by-step process of how you can transfer documents from Google Drive to OneDrive in an easy way. PicBackMan is the fastest and easiest app to move or transfer your photos and videos from OneDrive to Google Drive. And it's free to start. You can copy or move files/folders directly from OneDrive to Google Drive. Otherwise, you can download the files you need and then upload them to Google Drive. From your desktop, open ttkarsenal.ru file that you downloaded earlier from Google Drive, select all of the files, and drag them to your OneDrive folder. Here we will share you with 3 quick ways to transfer files from Google Drive to OneDrive without downloading files to a local disk from Google Drive. Transfer files from Google Drive to Onedrive and vice versa. No download and re-upload. MultCloud is a free web-based tool that enables you to easily transfer. PicBackMan is the fastest and easiest app to move or transfer your photos and videos from OneDrive to Google Drive. And it's free to start. 4. Google Drive to OneDrive migration process · 1. Navigate to Files > User List · 2. Click on Manage on the action bar and select Import · 3. If required, click. Approach 1 - Download and upload your files using the Google Drive & OneDrive App. This is the easiest and probably the most simplistic path. Migrate Google Drive to OneDrive · Visit the Easy Cloud Manager website, and create a new account. · Click the Google Drive icon, and then click Continue in the. The most traditional way to migrate files from Google Drive to OneDrive is by downloading a copy of the Google Drive files. Then upload those files into. Download the files from Google Drive to your local hard drive and upload them to OneDrive. Use Google Takeout and share feature to transfer files from. Step 1. Tap Cloud Sync on the page of MultCloud, choose Google Docs in Google Drive as the source, and choose a folder in OneDrive as the destination. #4 BitRecover Cloud Migration Tool · It transfers Google Drive data to OneDrive for Business with accuracy. · This tool can transfer files from. I'm trying to copy files from Google Drive to OneDrive. When I setup the profile and try to run it, it asks me to login to my Google Account. Upload Files to OneDrive – Once you download the files and folders, go to the OneDrive app. After that, click on the 'upload' button. Then, select the files and. Run the Google Drive to OneDrive migration tool. Choose the documents. Enter the destination account details. Successfully migrate Google Drive data. Q. 3. Next, choose the Cloud Transfer option. You can select files or folders in Shard Drive as the source. Then choose OneDrive as the transfer destination. Click. Yes, by visiting your OneDrive account in a browser and downloading the files to your computer, you can manually move stuff from OneDrive to. How do I move files from Google Drive to local Drive?

How To Qualify As Accredited Investor

In summary, an accredited investor must demonstrate an annual income of $, ($, for joint income) for the last two years with. What is an accredited investor? · A net worth in excess of $1,,, not including your primary residence; or · Historic and expected income of over $, . What are the requirements for an individual to qualify as an “accredited investor” based on net worth? The individual must have a net worth greater than $1. What Is an Accredited Investor? · Net worth over $1 million, excluding their primary residence (individually or with spouse or partner). · Income over $, . To be considered an accredited investor, you need a net worth of $1 million or a salary of $,, or joint salary of $, or more, for the immediate. Requirements of accredited investors based on countries · US – To be considered an accredited investor in the United States, the individual must possess a net. An individual or couple must have a net worth of at least $1 million to qualify as an accredited investor. A married couple, or someone with a spousal. Financial statements and associated account details · A credit report · Reliable confirmation of individual or joint net worth · Evidence of a candidate qualifying. By assets: Individuals can be considered accredited investors if they have a net worth (assets minus debts) of at least $1 million, not including their primary. In summary, an accredited investor must demonstrate an annual income of $, ($, for joint income) for the last two years with. What is an accredited investor? · A net worth in excess of $1,,, not including your primary residence; or · Historic and expected income of over $, . What are the requirements for an individual to qualify as an “accredited investor” based on net worth? The individual must have a net worth greater than $1. What Is an Accredited Investor? · Net worth over $1 million, excluding their primary residence (individually or with spouse or partner). · Income over $, . To be considered an accredited investor, you need a net worth of $1 million or a salary of $,, or joint salary of $, or more, for the immediate. Requirements of accredited investors based on countries · US – To be considered an accredited investor in the United States, the individual must possess a net. An individual or couple must have a net worth of at least $1 million to qualify as an accredited investor. A married couple, or someone with a spousal. Financial statements and associated account details · A credit report · Reliable confirmation of individual or joint net worth · Evidence of a candidate qualifying. By assets: Individuals can be considered accredited investors if they have a net worth (assets minus debts) of at least $1 million, not including their primary.

At a minimum, your investors should confirm that they are accredited investors. Typically, this is done by asking your investor to respond to a questionnaire at. An accredited investor is a term used by the SEC to describe individuals or entities that meet specific financial requirements. The definition of an accredited. While the client qualifies as an accredited advisor, someone who has more financial and business experience may need to oversee the investments. This. An accredited investor is a term used by the U.S. Securities and Exchange Commission (SEC) under Rule of Regulation D. In order to qualify for. Yes, you apply for a permit and get an ID card. No picture but they take a thumbprint. You must bring in your bank and brokerage statements and. The most direct way to become an accredited investor is to have a net worth that exceeds $1 million or earns at least $, per year. Firms will consider. Investment vehicles looking to determine if someone is an accredited investor will ask for proof. This may come in the form of any available W-2s, other. Put simply, you're an accredited investor if: You earned more than $, in each of the last two years (or more than $, together with your spouse in. There is no formal process that an individual or institution must follow in order to become an accredited investor. The task of verifying whether an individual. According to Regulation D of the Securities Act of , the term accredited investor refers to any investor who has maintained a certain level of income or. Likely the most common way to become a verified accredited investor is by having a certain income level. You can be deemed an accredited investor if you have. Certain types of institutions such as financial institutions, insurance companies, investment funds, etc.; or · Investors holding financial investments exceeding. Accredited investors are individuals qualified to invest in apartment syndications by having annual income of $k, or $k for joint income. Current Accreditation Requirements · To be an individual accredited investor you must either: · To be a joint accredited investor with your spouse you must either. An accredited or sophisticated investor is an investor with a special status under financial regulation laws. The definition of an accredited investor (if. So the best way to become an accredited investor is to meet the criteria. That means either an income of at least $,, a net worth of $1,, or more . According to the Securities and Exchange Commission (SEC), to qualify as an accredited investor, an individual must have an annual income of at least $, . Accessibility: While you can access high-return, private fund securities only by becoming an accredited investor, fine wine has no such limitation. Investing. Under Rule (a)(8) of Regulation D, promulgated under the Securities Act, a private investment company with assets of $5,, or less may qualify as an. What Are the Requirements to Be an Accredited Investor? · Has at least two years of income of $, ($, if combined with income from a spouse) and.

Are Home Equity Loans Still Available

The cost of borrowing through a home equity loan is also significantly lower than other forms of borrowing (such as personal loans) although still higher than. With a home equity loan or home equity line of credit (HELOC), your goals are within reach. Get funds to pay for a variety of expenses. Navy Federal Credit Union has great rates on home equity loans, available to our members. Explore home equity options and learn more here. The cost of borrowing through a home equity loan is also significantly lower than other forms of borrowing (such as personal loans) although still higher than. Home equity loans can be used to pay for major expenses such as a new or used vehicle, college tuition, medical bills, or any repairs, renovations, and upgrades. If you have property in Texas, a home equity loan or home equity line of credit (HELOC) can be an economical way to obtain a low-rate loan. As you repay your outstanding balance, the amount of available credit is replenished – much like a credit card. This means you can borrow against it again if. A home equity loan allows you to borrow against your equity, or the portion of your home that you own. These loans, also called second mortgages, have. Typically, a HELOC will remain open for a set term, perhaps 10 years. Then the draw period will end, and the loan will be amortized—which means you begin making. The cost of borrowing through a home equity loan is also significantly lower than other forms of borrowing (such as personal loans) although still higher than. With a home equity loan or home equity line of credit (HELOC), your goals are within reach. Get funds to pay for a variety of expenses. Navy Federal Credit Union has great rates on home equity loans, available to our members. Explore home equity options and learn more here. The cost of borrowing through a home equity loan is also significantly lower than other forms of borrowing (such as personal loans) although still higher than. Home equity loans can be used to pay for major expenses such as a new or used vehicle, college tuition, medical bills, or any repairs, renovations, and upgrades. If you have property in Texas, a home equity loan or home equity line of credit (HELOC) can be an economical way to obtain a low-rate loan. As you repay your outstanding balance, the amount of available credit is replenished – much like a credit card. This means you can borrow against it again if. A home equity loan allows you to borrow against your equity, or the portion of your home that you own. These loans, also called second mortgages, have. Typically, a HELOC will remain open for a set term, perhaps 10 years. Then the draw period will end, and the loan will be amortized—which means you begin making.

Some specialized home equity lenders set LTV ratios at 90% or higher, while most follow the 85% LTV maximum. What Home Equity Loan Amount Do You Need? $, Home equity loans are available from many of the same lenders that issue regular mortgages. If you belong to a credit union, it will most likely offer a home. PNC, NerdWallet's #1 HELOC lender for , is ideal for paying off credit cards, home renovations, mortgage refinance & allows you to lock a fixed rate. Refinancing your mortgage can allow you to access available equity by taking cash out. Start with our refinance calculator to estimate your rate and payments. A home equity loan is a second mortgage that lets you pull cash from your home equity. Unlike HELOCs, home equity loans come with low, fixed rates. Like other types of home equity loans, you'll be responsible for paying an additional mortgage; a home equity loan doesn't replace your mortgage with a new one. While home equity loan and HELOC interest rates can fluctuate, the rates offered on these home equity products are typically still better than other financing. PNC, NerdWallet's #1 HELOC lender for , is ideal for paying off credit cards, home renovations, mortgage refinance & allows you to lock a fixed rate. Homeowners often use a home equity loan for home improvements, to pay for a new car, or to finance their child's college education. Because the loan is secured. Home equity loans allow you to borrow cash based on the equity in your primary home. A home equity loan may be a first lien or a second lien on your home. On a $75, loan balance, monthly payment would be $ interest-only at the current % APR. The term of the HELOC is 25 years: year draw period, Then the lender must cancel its security interest in your home and must also return fees you paid to open the plan. If the required notice and disclosures are. Our Home Equity Loans are available in every state except Hawaii, Alaska, and Texas. common questions. Q: What is a High-Cost Mortgage Loan? A: In some. Dollar Bank offers Home Equity Loans and Home Equity Lines of Credit It's an open-ended loan that gives you the flexibility to borrow again and. While home equity loan and HELOC interest rates can fluctuate, the rates offered on these home equity products are typically still better than other financing. Online and mobile banking will still be available 24/7. Click here for more (1) Home Equity Loans and Credit Lines are not available in Puerto Rico. Our home equity loan options turn the equity you've built into cash you can use for all sorts of needs. Each comes with a lower rate than most other banks and. 10 and 15 year terms available. Both terms have a 5 year draw period. Payments are fully amortized during each period and determined on the outstanding. Homeowners may use the money from these second mortgages – available as a lump sum home equity loan or as a home equity line of credit – for any purpose. When it comes to utilizing the equity in your home, the opportunities are endless. A home equity loan is not only used for home improvements, but many members.

Gwl Promo Codes

Great Wolf Lodge HOWLING FANS Discounts, Codes, Tips and Tricks! GWL · Smart Moms Do Disney in Four · Deals For Kids · Stay At Home Moms · Great Wolf. Up to 30% off. Book and save on your 4th of July week getaway at Great Wolf. Stay Dates: 07/03/ - 10/31/ Book By: 07/07/ Apply Code: JUMP. Save 60% with 27 verified Great Wolf Lodge promo codes for August SimplyCodes uses AI and crowdsourcing to find Great Wolf Lodge coupons that. with code PROMO. Indoor Amusement Park · Local · Things To Do · Kids Activities gwl-gurnee-4","timezone":"America/Chicago","options":[{"title":"Events at. How much is a Great Wolf Lodge Day Pass? Is there a Great Wold Lodge Day Pass promo code? Save BIG on your stay in ! NOTE: Cash back is not available for the Niagara Falls, Canada location. Use of coupons and promotional codes not on ttkarsenal.ru may void cash back. Ad. The Deal: 15% Off Great Wolf Lodge Day Pass with Rate Code CERTKWP. What You Need to Know: Not valid at Niagara Falls location. Hurry - Limited Time Offer! 33+ active Great Wolf Lodge Promo Codes, Coupon Codes & Deals for Aug Most popular: 60% Off Sitewide with Great Wolf Lodge Promo Code: BENEF*****. Great Wolf Lodge Coupon: 30% Off on Stays of Two Nights or More. Experience substantial savings of 30% off your total lodging cost when you book a stay for. Great Wolf Lodge HOWLING FANS Discounts, Codes, Tips and Tricks! GWL · Smart Moms Do Disney in Four · Deals For Kids · Stay At Home Moms · Great Wolf. Up to 30% off. Book and save on your 4th of July week getaway at Great Wolf. Stay Dates: 07/03/ - 10/31/ Book By: 07/07/ Apply Code: JUMP. Save 60% with 27 verified Great Wolf Lodge promo codes for August SimplyCodes uses AI and crowdsourcing to find Great Wolf Lodge coupons that. with code PROMO. Indoor Amusement Park · Local · Things To Do · Kids Activities gwl-gurnee-4","timezone":"America/Chicago","options":[{"title":"Events at. How much is a Great Wolf Lodge Day Pass? Is there a Great Wold Lodge Day Pass promo code? Save BIG on your stay in ! NOTE: Cash back is not available for the Niagara Falls, Canada location. Use of coupons and promotional codes not on ttkarsenal.ru may void cash back. Ad. The Deal: 15% Off Great Wolf Lodge Day Pass with Rate Code CERTKWP. What You Need to Know: Not valid at Niagara Falls location. Hurry - Limited Time Offer! 33+ active Great Wolf Lodge Promo Codes, Coupon Codes & Deals for Aug Most popular: 60% Off Sitewide with Great Wolf Lodge Promo Code: BENEF*****. Great Wolf Lodge Coupon: 30% Off on Stays of Two Nights or More. Experience substantial savings of 30% off your total lodging cost when you book a stay for.

Discover and save on s of great deals at nearby restaurants, spas, things to do, shopping, travel and more $ with code LDWTRIP. All-Inclusive. Find the latest Great Wolf Lodge promo codes, coupons & deals for August - plus earn % Cash Back at Rakuten. Join now for a free $10 Welcome Bonus. Search for Great Wolf Lodge promo codes - 5 valid coupon codes and discounts in August Best offer today: save up to 50% on Great Wolf Lodge deals and. You need to reserve at least one night to qualify. I tried to book a reservation using these coupon codes, but Great Wolf Lodge says it's full. Can you add more. Find the best Great Wolf Lodge coupons valid for August Save on your holiday with 8 promo codes and deals with a top discount of 40%. Referral Codes are typically $50 off your first reservation and can be stacked with other promos or deals. Must be used on a new GWL account -. Promotional codes are valid for overnight room reservations. We also offer multiple attractions and dining packages that provide discounts to various lodge. Answer 11 of I am going back to GWL in Grapevine in late October. So far all the promo codes I have used are only valid until the end of August or. Promo code: BB Example: March , Nov We booked a family suite Any known working codes for GWL? I'm looking to take my family of 6 but. Heroes Day Pass Savings A special discount for first responders. Stay Dates: Valid from 09/01/ - 12/31/ Offer Code: WPHEROES. Bounce Back | Save up to 40% on a one night stay or up to 50% on a two+ night stay! Discount may vary by date. POSSIBLY EXPIRED CODES. BB Save up to 40%. Check if the items in your shopping cart are applicable for the discount code. Check if the coupon code is expired. Some codes or offers cannot be combined with. Save 65% with our Great Wolf Lodge Coupon & Discount Code at ttkarsenal.ru % working Great Wolf Lodge Promotion Code, updated and verified this July. Get the best coupons, promo codes & deals for Great Wolf Lodge in at Capital One Shopping. Our community found 1 coupons and codes for Great Wolf. The Best Great Wolf Lodge promo code is 'WPSEASONAL'. The best Great Wolf Lodge promo code available is WPSEASONAL. This code gives customers 30% off at Great. Great Wolf Lodge gives discounts for children who are Girl Scouts or Boy Scouts. Use "SCOUT" in the offer code section. I think it is 10% off, on the Family. The Great Wolf Lodge offers a military discount Visit the Great Wolf Lodge website for details and to find a location near you. Discount code. 60% Off Great Wolf Lodge Promo Code (20 Active) Aug '24 · Great Wolf Lodge Coupon: Extra 60% Off Site-wide · Great Wolf Lodge Coupon: Get Up To 30% Off Sitewide. August Great Wolf Lodge Promo Codes | PLUS earn a up to 1% bonus | Save an average of $39 | Use one of our 29 best coupons | Offers hand tested on.

Best Travel Insurance For Over 70

Over 70s can either buy single trip or multi-trip travel insurance. A multi-trip policy can work out cheaper if you take more than two or three holidays each. Try M&S Bank, Churchill, Direct Line and Aviva (with travel disruption cover). They all meet our normal minimum cover levels, and most go beyond. Though DON. Travel insurance for seniors offers a range of benefits, including coverage for medical emergencies, trip cancellations, and lost belongings. PayingTooMuch is a price comparison site using trusted providers to compare quality travel insurance at an affordable price. They specialise in cover for pre-. Get over 70s Travel Insurance with up to unlimited medical expenses. No upper age limit. Most pre-existing medical conditions covered. Get a quote now. GlobeHopper Senior provides quality, affordable travel medical insurance to seniors over the age of Experience more and worry less with IMG. If you're a senior traveller planning a trip overseas, you'll need to get the right cover in place before you set off. Travel insurance for the over 70s is. Best Senior Travel Insurance Companies of Summary · Best overall: Allianz Travel Insurance · Best for expensive trips: John Hancock Travel Insurance · Best. Tin Leg and Trawick International offer the best travel insurance for seniors, according to our analysis of plans' cost and coverage limits. Over 70s can either buy single trip or multi-trip travel insurance. A multi-trip policy can work out cheaper if you take more than two or three holidays each. Try M&S Bank, Churchill, Direct Line and Aviva (with travel disruption cover). They all meet our normal minimum cover levels, and most go beyond. Though DON. Travel insurance for seniors offers a range of benefits, including coverage for medical emergencies, trip cancellations, and lost belongings. PayingTooMuch is a price comparison site using trusted providers to compare quality travel insurance at an affordable price. They specialise in cover for pre-. Get over 70s Travel Insurance with up to unlimited medical expenses. No upper age limit. Most pre-existing medical conditions covered. Get a quote now. GlobeHopper Senior provides quality, affordable travel medical insurance to seniors over the age of Experience more and worry less with IMG. If you're a senior traveller planning a trip overseas, you'll need to get the right cover in place before you set off. Travel insurance for the over 70s is. Best Senior Travel Insurance Companies of Summary · Best overall: Allianz Travel Insurance · Best for expensive trips: John Hancock Travel Insurance · Best. Tin Leg and Trawick International offer the best travel insurance for seniors, according to our analysis of plans' cost and coverage limits.

Travelsafe Travel Insurance: Travelsafe offers basic, classic, and classic plus full-featured plans, all of which offer both trip and medical coverage, with a. Best Senior Travel Insurance Companies of Summary · Best overall: Allianz Travel Insurance · Best for expensive trips: John Hancock Travel Insurance · Best. Anybody who is sixty-plus and wishes to travel the world can buy the best senior citizen travel insurance. Policy Extension: Worry not if you plan on extending. This is especially true if you're looking for travel insurance and are over 65 with medical conditions. Holiday insurance when over 65 is offered by some. Patriot America plus is Comprehensive travel insurance covers acute on set of pre-existing conditions up to chosen maximum limit aged up to 70 years. This plan. Senior travelers and retirees should consider a comprehensive trip protection plan that includes travel health insurance plus coverage for trip cancellation. Whether you need essential travel medical insurance or coverage for lost baggage, trip cancellation and interruption, and other unexpected events, we offer a. Best Travel Insurance Plans for Seniors Traveling to the U.S. For travelers ages , CoverAmerica-Gold is an excellent solution for a trip abroad. Why choose Free Spirit for travel insurance over 70? · Single trips covered up to days (45 days if you're aged 76 years or over) · Annual multi-trip cover. Travel Insurance for Seniors. Travel only gets better when you're over You have enough experience to be comfortable anywhere in the. Just Travel Cover works with a range of specialist insurers to provide over 70s Travel Insurance with cover for hundreds of pre-existing medical conditions. American Visitor Insurance offers several high rated travel medical insurance plans suitable for senior citizens traveling to the US. Comprehensive US visitor. Short-term visitors to the USA will typically not be eligible for travel insurance for seniors through the AARP. Your best option will be to shop for visitors. Bank Accounts with Travel Insurance for Over 70s ; Nationwide FlexPlus. World family travel insurance (max age 69 or 70+ with £65/year upgrade). £13/month (+65/. The “best” travel insurance depends on specific needs, but some highly rated options for seniors over 70 include companies like IMG and GeoBlue. These offer. Based on our research, the best travel insurance plans for seniors are from Seven Corners, Generali, Tin Leg, Trawick, AEGIS & FAYE. (skip ahead to view these. medical treatment, so you can still get good value for money. Senior Travel insurance guides and tools. Travel insurance for over 70s. Find out. Travel insurance for over 70s is a type of travel insurance policy that covers the specific needs of older travellers, including any pre-existing health. Geoblue Voyager Choice Premier Health Insurance for International Travel up to Age 94 · One of the best travel medical insurance policies anywhere! · For U.S. World Nomads has partnered with TripAssure to support and administer trip protection for Silver Nomads aged 70 and over.

0 Intro Balance Transfer

0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. Transferring a balance to get a 0% introductory rate for 12 months doesn't mean just forgetting about the balance. The cardholder has to make minimum payments. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After the intro APR. Credit Card Balance Transfer. 0% APR* Intro/Promo on Balance Transfers for 6 Months. Transfer Your balance. Swing Into Savings With a CRCU Mastercard®! Ready. 0% introductory APR balance transfers for first 18 billing cycles after account opening. Regular APR. %, %, %, % or %. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies. By transferring your balance to a card with a 0% intro APR, you can quickly dodge mounting interest costs and give yourself repayment flexibility. However. 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be % - %, based on your creditworthiness. Earn 5%. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. Transferring a balance to get a 0% introductory rate for 12 months doesn't mean just forgetting about the balance. The cardholder has to make minimum payments. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After the intro APR. Credit Card Balance Transfer. 0% APR* Intro/Promo on Balance Transfers for 6 Months. Transfer Your balance. Swing Into Savings With a CRCU Mastercard®! Ready. 0% introductory APR balance transfers for first 18 billing cycles after account opening. Regular APR. %, %, %, % or %. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies. By transferring your balance to a card with a 0% intro APR, you can quickly dodge mounting interest costs and give yourself repayment flexibility. However. 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be % - %, based on your creditworthiness. Earn 5%.

Balance Transfer, 0% Intro APR, Looking for Guidance. Debt. I have an offer to transfer balances up to $11, to my existing Discover credit. A balance transfer is the act of paying off one credit card with another credit card. The credit card debt still remains, but the balance is shifted between. Enjoy 0% intro APR on balance transfers for the first 18 billing cycles after account opening with a TD FlexPay Credit Card. Unlock the features of your new. Explore Capital One 0% Intro APR Credit Card Benefits · No Foreign Transaction Fees. You won't pay a transaction fee when making a purchase outside of the United. Balance transfer offer: Balance transfers you make within days of account opening qualify for a 0% intro APR for 21 months, after that a variable %. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. Some credit cards offer an introductory period – often 12 to 18 months – with 0% interest on purchases and, potentially, balance transfers. 10 partner offers ; Citi Double Cash Card · 0% for 18 months on Balance Transfers · % - % (Variable) ; Wells Fargo Reflect Card · 0% intro APR for The idea is that the lower rate will save you money on interest. The best balance transfer credit cards usually come with no annual fee and a 0% intro APR. The card gives you a 0% introductory APR for 18 billing cycles for both purchases and balance transfers made in the first 60 days after your account opens. Both. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. A balance transfer card may offer perks—like 0% introductory APR or no annual fee—that could help you save big. Some cards even let you earn rewards in the form. With a 0% intro balance transfer APR card, you pay no interest on balance transfers during the promotional period. After the promotional period, the standard. Save up to hundreds of dollars a year on interest. Get introductory low interest rate on balance transfers for first 6 months with Scotiabank Value Visa. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After the intro APR offer. More Savings = Less Stress · 0% intro APR for the first 12 months · No balance transfer fee · No annual fee · Unlimited rewards up to % on all purchases. New Cardholders: 0% for 12 months introductory APR on purchases within the first year and balance transfers completed within the first 90 days of account. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that. Many credit cards offer promotional 0% rates on balance transfers. Promotional periods vary from 6 to 21 months, depending on the offer.

Best Cd Savings

Right now, the best 1-year CD rate is % APY from Mountain America Credit Union and Merchants Bank of Indiana. Compare the highest 1-year CD rates. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. Best CD Rates of September · Best for 3-Month CDs: EverBank Basic CD 3-Month CD at % APY · Best for 6-Month CDs: CommunityWide Federal Credit Union. Choose the Certificate of Deposit term length that works best for you. Explore our CD Specials below and open an account today. man opening a certificate of. Best CD Rates of September · Best for 3-Month CDs: EverBank Basic CD 3-Month CD at % APY · Best for 6-Month CDs: CommunityWide Federal Credit Union. CD rate news The best CDs currently range from % to % — with some promo rates as high as % — which is higher than average compared with the. Best 2-year CD rates The highest 2-year CD rate today is % from Colorado Federal Savings Bank. CDs offer a satisfying and stable way to grow your savings. Earn a competitive yield and receive a guaranteed rate for the entire term of your CD. Certificate Of Deposit · Chase Bank CD Rates · Bank Of America CD Rates · Wells Fargo CD Rates · Capital One CD Rates · Citibank CD Rates · Navy Federal CD Rates. Right now, the best 1-year CD rate is % APY from Mountain America Credit Union and Merchants Bank of Indiana. Compare the highest 1-year CD rates. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. Best CD Rates of September · Best for 3-Month CDs: EverBank Basic CD 3-Month CD at % APY · Best for 6-Month CDs: CommunityWide Federal Credit Union. Choose the Certificate of Deposit term length that works best for you. Explore our CD Specials below and open an account today. man opening a certificate of. Best CD Rates of September · Best for 3-Month CDs: EverBank Basic CD 3-Month CD at % APY · Best for 6-Month CDs: CommunityWide Federal Credit Union. CD rate news The best CDs currently range from % to % — with some promo rates as high as % — which is higher than average compared with the. Best 2-year CD rates The highest 2-year CD rate today is % from Colorado Federal Savings Bank. CDs offer a satisfying and stable way to grow your savings. Earn a competitive yield and receive a guaranteed rate for the entire term of your CD. Certificate Of Deposit · Chase Bank CD Rates · Bank Of America CD Rates · Wells Fargo CD Rates · Capital One CD Rates · Citibank CD Rates · Navy Federal CD Rates.

a great rate on your terms. Open a Tiered Long-Term CD with $10, – $99, or a High-Yield Jumbo CD with $, – $, Earn the Relationship. A CD is a secure way to grow your savings with a higher interest rate than a regular savings account. At TowneBank, a personal banker can assist you in choosing. The best CD rates today are above 5% for one-year terms and above 4% for three- to five-year terms. CDs provide a boost to savings, with certain limits. The best CD rate right now is % APY available from 10 different banks or credit unions with terms ranging from three months to 12 months. The highest certificates of deposit (CDs) rates today are offered by Merchants Bank of Indiana (%), First Federal of Lakewood (%), Shoreham Bank. Certificate Of Deposit · Chase Bank CD Rates · Bank Of America CD Rates · Wells Fargo CD Rates · Capital One CD Rates · Citibank CD Rates · Navy Federal CD Rates. 60 MONTHS Quontic's CDs shine with top rates across terms from six months to five years, and the opening minimum of $ is relatively low compared to other. Certificates of deposit (CDs) can be a good choice when you want steady, predictable investment income that is federally insured Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. The National Average is based on the APY average for certificate of deposit accounts with a minimum balance of at least $2, offered by the top 50 US banks . If you have savings that you won't need to access for a while, a Certificate of Deposit might be an ideal savings plan. Generally, the longer your term length. Renew the CD at a term and rate that is best for you,; Add funds or generally make withdrawals,; Close the CD. Interest is only paid through the maturity date. High-Growth Certificates of Deposit ; CDs · Rates Effective 09/13/ ; Term, Tier, Annual Percentage Yield (APY) ; 6 months, $ - $49,, % ; $50, -. According to the FDIC, average interest rates on CDs ranged from % (for one-month CDs) to % (for five-year CDs), as of January A Certificate of Deposit (CD) rate you can take to the bank · Now % APY CD for a limited time. · High-earning savings when you don't need immediate access to. Looking for high-yield CDs to elevate your savings? Explore Apple Bank's best 1-year and other term rates and open a Certificate of Deposit today! 5-year CD rates. SchoolsFirst Federal Credit Union — % APY; First Internet Bank of Indiana — % APY; Synchrony Bank — % APY. CD Rates Earn our best rate no matter the term – whether short or long. Start growing your savings today and secure your financial future with us! With a. Southern Bank's best CDs feature rates up to % APY. Learn more about our CD rates or try our interest-earning calculator on our website today! Bask Bank is an excellent option if you'd like to earn a competitive interest rate on a high-yield savings account or CD. Most of its other CD terms offer great.