ttkarsenal.ru Overview

Overview

Tesla Stock Price Forecast 2025

Forecasts for are even more variable. Tesla's final stock price will depend heavily on its financial results. The factor of Ilon Musk's. Tesla Inc. (TSLA) Stock Price Prediction, Stock Forecast for next months and years ; February , Open: , Close: , Min: , Max: According to analysts, TSLA price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a. View live Tesla chart to track its stock's price action. Find market predictions, TSLA financials and market news. According to analysts, TSLA price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a. TSLA | Complete Tesla Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. According to the latest long-term forecast, Tesla price will hit $ by the end of and then $ by the middle of Tesla will rise to $ within the. Finance · My Portfolio · News · Latest News · Stock Market · Originals · Premium News Next Year (). No. of Analysts, 26, 25, 35, Avg. Estimate, This means that if you invested $ now, your current investment may be worth $ on September 02, Tuesday. This means that this stock is not suited as a. Forecasts for are even more variable. Tesla's final stock price will depend heavily on its financial results. The factor of Ilon Musk's. Tesla Inc. (TSLA) Stock Price Prediction, Stock Forecast for next months and years ; February , Open: , Close: , Min: , Max: According to analysts, TSLA price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a. View live Tesla chart to track its stock's price action. Find market predictions, TSLA financials and market news. According to analysts, TSLA price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a. TSLA | Complete Tesla Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. According to the latest long-term forecast, Tesla price will hit $ by the end of and then $ by the middle of Tesla will rise to $ within the. Finance · My Portfolio · News · Latest News · Stock Market · Originals · Premium News Next Year (). No. of Analysts, 26, 25, 35, Avg. Estimate, This means that if you invested $ now, your current investment may be worth $ on September 02, Tuesday. This means that this stock is not suited as a.

While economic growth may be uneven in and , we believe the Fed has the ability to bolster growth if needed. Analyst Report. Shares in the electric vehicle (EV) maker will surge to $3, by , according to a report on Friday. That's more than quadruple the current price, even. In the medium to long term, Tesla stock could gaine % and trade at $ on Feb 15, In the next year, our stock price prediction algorithm. What is the Tesla stock forecast? · Tesla stock prediction for 1 year from now: $ (%) · Tesla stock forecast for $ (%) · Tesla. Based on 31 Wall Street analysts offering 12 month price targets for Tesla in the last 3 months. The average price target is $ with a high forecast of. Tesla stock prediction for April The forecast for beginning dollars. Maximum price , minimum Averaged Tesla stock price for the month At. Tesla's shares might reach an average price of $1, by the end of , according to Tesla's price prognosis and estimate. Tesla (TSLA) Based on short-term price targets offered by 34 analysts, the average price target for Tesla comes to $ The forecasts range from a low of $ to a. Am thinking of purchasing a large amount of stock as I believe AI is certainly the future. I like the price compared to NVDA. What is your price prediction for Tesla stock? While nobody can How do I stock predictions in ? Reversion to the mean is said. Tesla stock prediction for August In the beginning at Maximum , minimum The averaged price At the end of the month Get expert predictions for Tesla (TSLA) stock prices for the next 5 and 10 years. Stay ahead with in-depth insights on future market trends and investment. They continue to predict that by the stock would hit $3, Adjusted for splits that is $1, Their worst case scenario for is. Tesla Stock Forecast, TSLA stock price prediction. Price target in 14 , , , with daily TSLA exchange price projections: monthly. Now, let's paint a picture with some big, bold digits. By , I'm predicting that Tesla's stock price will be hovering around the 3,mark. The 33 analysts with month price forecasts for Tesla stock have an average target of , with a low estimate of and a high estimate of Analyst Estimates: More Content: Snapshot, Stock Price Targets, Yearly Numbers, TSLA will report earnings on 01/22/ 0R0X Stock Forecast FAQ What is GB:0R0X's average month price target, according to analysts? Based on analyst ratings, Tesla's month average price. Analyst Estimates: More Content: Snapshot, Stock Price Targets, Yearly Numbers, TSLA will report earnings on 01/22/ Tesla said it expects a 50 percent compound annual growth rate in the supply of its cars, in which case by the company will be shipping 40 times as many.

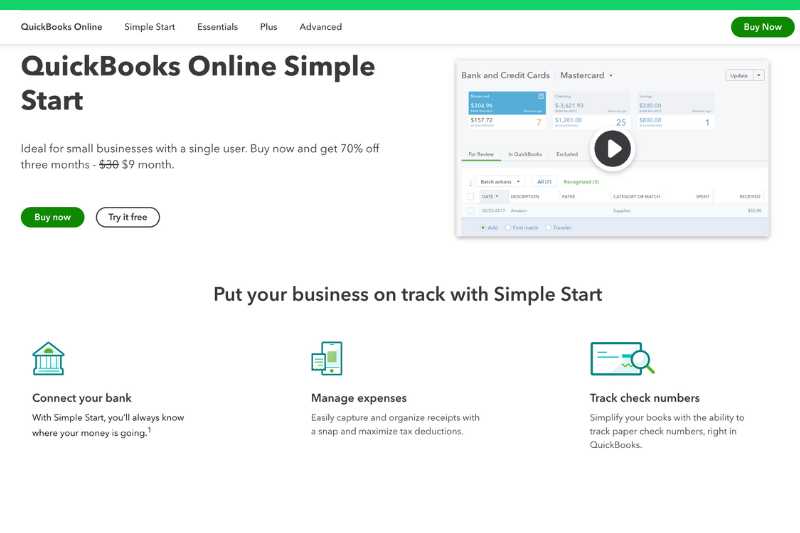

Is Quickbooks Online Easy To Use

QuickBooks Online Drawbacks QuickBooks Online is an impressive accounting system that's easy to use and includes all the features most small businesses need. Custom-built for your business of one. QuickBooks Solopreneur features easy-to-use tools to help you drive growth and financial stability. QuickBooks Online gives you a modern, streamlined, intuitive design that simplifies tasks and makes it easier to avoid mistakes. Intuitive design that. QuickBooks is designed to be user-friendly and easy to use, even for individuals who do not have an accounting background. However, having an accountant or. Comments: Overall, Quickbooks Online can replace the accounting software of most small-to-medium businesses. It's easy to use and fast. You can use Quickbooks. QuickBooks Online is easy to use. Many startups and small businesses alike begin using QuickBooks Online because of its user experience; QBO is one of the. QuickBooks Online is typically easier to use than the desktop version, but it has fewer features. In conclusion, QuickBooks is not necessarily hard to learn. QuickBooks Online is designed to help you manage your business finances with ease. Grow your business effortlessly with our all-in-one online business. Having the online version just makes sense. There are apps that integrate with it, you can log in on your phone, [and] the data is easily accessible to both the. QuickBooks Online Drawbacks QuickBooks Online is an impressive accounting system that's easy to use and includes all the features most small businesses need. Custom-built for your business of one. QuickBooks Solopreneur features easy-to-use tools to help you drive growth and financial stability. QuickBooks Online gives you a modern, streamlined, intuitive design that simplifies tasks and makes it easier to avoid mistakes. Intuitive design that. QuickBooks is designed to be user-friendly and easy to use, even for individuals who do not have an accounting background. However, having an accountant or. Comments: Overall, Quickbooks Online can replace the accounting software of most small-to-medium businesses. It's easy to use and fast. You can use Quickbooks. QuickBooks Online is easy to use. Many startups and small businesses alike begin using QuickBooks Online because of its user experience; QBO is one of the. QuickBooks Online is typically easier to use than the desktop version, but it has fewer features. In conclusion, QuickBooks is not necessarily hard to learn. QuickBooks Online is designed to help you manage your business finances with ease. Grow your business effortlessly with our all-in-one online business. Having the online version just makes sense. There are apps that integrate with it, you can log in on your phone, [and] the data is easily accessible to both the.

QuickBooks has proven to be the software that small businesses go to because it is easy to get started. It is also an affordable accounting system compared to. QuickBooks has easy-to-use software that is customer oriented. Even if your company does not have a big accounting department, this software is made to be used. QuickBooks Online Simple Start's intuitive tabs and graphics make it a good choice for people new to online billing, invoicing and accounting. There are a few versions of QuickBooks, and QuickBooks Online is perhaps the most popular online accounting software for SMBs because it is easy-to-use. Yes, a non-financial person can use QuickBooks. QuickBooks is designed to be easy to use, even for people with no prior accounting experience. You can save time, automate your bookkeeping, track your sales tax and payroll tax and make use of the reporting features available in the various plans. You. And its user-friendly interface and live bookkeeping support make it easy to use – even if you're not an accounting whiz! With QuickBooks Online, you can easily. Pros of QuickBooks Online vs Desktop · Use anytime, anywhere with an Internet connection and login · No servers required on-premises · Reduces need for IT staff. 90% of customers agree that QuickBooks Online Advanced is easy to use Buy now. Important offers, pricing details and disclaimers. Money movement services. Quickbooks online is the only thing that will work with more than one device. Plus your CPA can access your files too. Very convenient. Data and. Used by over 7 million customers globally, QuickBooks Online provides smart tools for your business, yet is easy to use. You can organize your books, manage. Ease of Use. After testing QuickBooks Online ourselves, we think users will have an easy time navigating and learning the software. Although the feature-packed. What is QuickBooks Online for a Simple Start? QuickBooks Simple Start is one of the plans offered by QuickBooks under QuickBooks Online. This version of QBO. Online is also easier to use than Desktop due to its user-friendly interface and simplified screen navigation. User access: QuickBooks Online supports more. Quickbooks is very quick for expenses. You set up "rules" and can import your banking data. It takes me a couple of hours to book a year's work. Manage work your way QuickBooks Online Plus helps you manage and view all parts of your business, all in one place. Easily track labor costs, payroll, and. Although it has fewer capabilities than the desktop version, QuickBooks Online is often simpler to use. In conclusion, the amount of time it takes to learn. If you are using this for a small business and are not trained in bookkeeping/accounting, this is the easiest bookkeeping software on the market. Cons. If you. Organize & manage your business with the #1 rated solution. Fast & easy setup. Sign up for a free trial to join 7 million businesses already using.

California Deductions

Payroll Deductions, Payroll Taxes & Withholding, Estimating Net Pay, Outdated Pay Warrants, Reporting a Lost, Stolen, or Destroyed Pay Warrant. There are no scheduled upcoming events at this time. Footer Region. California State University, San Bernardino University Parkway San Bernardino, CA SmartAsset's California paycheck calculator shows your hourly and salary income after federal, state and local taxes. Enter your info to see your take home. If you live and/or work outside of California and withholding was required Certain deductions/elections may be “sheltered” from taxation resulting in a. Here is an overview of California's Top Ten Rental Property Tax Reductions that you can use year-to-year. A relatively comprehensive list of the various categories of tax deductions that are available to you as a business owner. Your California deduction may be different from your federal deduction. California limits the amount of your deduction to 50% of your federal adjusted gross. For information on deductions from exempt employees' salaries, see Deductions From an Exempt Employee's Salary. DE4 - California Employee's Withholding. The standard deductions in California for tax returns are $5, (Single or Married/RDP Filing Separately) and $10, (Married/RDP Filing Jointly. Payroll Deductions, Payroll Taxes & Withholding, Estimating Net Pay, Outdated Pay Warrants, Reporting a Lost, Stolen, or Destroyed Pay Warrant. There are no scheduled upcoming events at this time. Footer Region. California State University, San Bernardino University Parkway San Bernardino, CA SmartAsset's California paycheck calculator shows your hourly and salary income after federal, state and local taxes. Enter your info to see your take home. If you live and/or work outside of California and withholding was required Certain deductions/elections may be “sheltered” from taxation resulting in a. Here is an overview of California's Top Ten Rental Property Tax Reductions that you can use year-to-year. A relatively comprehensive list of the various categories of tax deductions that are available to you as a business owner. Your California deduction may be different from your federal deduction. California limits the amount of your deduction to 50% of your federal adjusted gross. For information on deductions from exempt employees' salaries, see Deductions From an Exempt Employee's Salary. DE4 - California Employee's Withholding. The standard deductions in California for tax returns are $5, (Single or Married/RDP Filing Separately) and $10, (Married/RDP Filing Jointly.

Young Child Tax Credit (YCTC) · Your total wages, salaries, tips, and other employee compensation (whether subject to California withholding or not), if any, do. How many allowances from estimated deductions do you have? Any additional withholding amount? Are you exempt from State Income Tax Withholding? Yes. No. For most households, the monthly gross income (before payroll deductions) must be at or below % of the Federal Poverty Level for the household size. Assembly Bill 80 (AB 80), the California bill to allow deductions for expenses paid with forgiven PPP debt, was signed by Governor Gavin Newsom on April What can I include in my California itemized deductions? · state tax withheld · mortgage insurance premiums · certain charitable donations over a certain amount. Browse California Code Of Regulations | Article 1 - Deductions for free on Casetext. Before launching into this topic, know this: The California Department of Social Services (CDSS) annually updates its list of maximum allowable deductions. There is an exception contained in the IWC Wage Orders indicating that an employer may deduct from an employee's wages any cash shortage, breakage or loss of. If you think that any of these deductions apply to you, contact your county welfare office. There is a special “Board and Care Deduction” (California Code of. deductions will be voluntarily authorized by the individual employees, the University of California |; Office of the President |; Academic Senate. 1. If you are caring for a friend, you can deduct their personal exemption. This tax break is for anyone supporting a friend financially. Wages paid to California residents for services performed both within and outside the state are subject to state income tax withholding. Read our discussion on the 7 top tax deductions available to Carmel, California small business owners. California Nonresident WithholdingNon-wage payments to nonresidents of California are subject to 7% state income tax withholding if the total payments. Determine the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms or SR). Itemized deductions must be reduced by the lesser of 6% of the excess of the California taxable income, with a maximum California. AGI of $92, A taxpayer whose itemized deductions exceed the amount of the standard deduction can reduce tax liability by electing to itemize deductions. Calculating child support in California requires totaling gross income and then subtracting certain deductions authorized by law. The calculation can be. IF YOU RELY ON THE FEDERAL FORM W-4 FOR YOUR CALIFORNIA WITHHOLDING ALLOWANCES, YOUR CALIFORNIA STATE. PERSONAL INCOME TAX MAY BE UNDERWITHHELD AND YOU MAY OWE. When California Employers May Subtract from Earned Compensation. Employers sometimes wish to make deductions from an employee's wages for a variety of.

How To Transfer Money From Fiat Wallet To Bank Account

Wait for 3 confirmations: 30 mins (expected average); Search for a LocalBitcoin user who deals with your currency, volume, payment method (bank. What is fiat money? In simple words, fiat money is the money we use every day: like dollars, euros, or pounds. It's not backed by a physical commodity like gold. To use a fiat wallet, you simply need to connect your crypto wallet to a bank account. After that, you need to transfer the fiat currency into the crypto wallet. Fiat wallets facilitate quick crypto investments by speeding up fund transfers. For example, if you were to transfer money directly from your bank to a. Simply go to the withdrawal drawer in your Fiat Wallet and tap Add a Bank Account. Follow the onscreen instructions and tap Submit to save your bank account. To withdraw the fiat borrowed funds from your YouHodler account using a bank wire, go to your Wallets and press the Withdraw button on the fiat wallet panel. Note that you have to connect your bank account to your Zengo wallet prior to requesting a fiat withdrawal and that it may take a few days for your funds to. Once your bank account is linked, select the “Deposit” option within your Fiat Wallet. Step 2: Enter Deposit Amount: Specify the amount you wish. Wait for the fiat partner to transfer money into your bank account. When you receive money, click on [I have received payment] to release NGNR for the fiat. Wait for 3 confirmations: 30 mins (expected average); Search for a LocalBitcoin user who deals with your currency, volume, payment method (bank. What is fiat money? In simple words, fiat money is the money we use every day: like dollars, euros, or pounds. It's not backed by a physical commodity like gold. To use a fiat wallet, you simply need to connect your crypto wallet to a bank account. After that, you need to transfer the fiat currency into the crypto wallet. Fiat wallets facilitate quick crypto investments by speeding up fund transfers. For example, if you were to transfer money directly from your bank to a. Simply go to the withdrawal drawer in your Fiat Wallet and tap Add a Bank Account. Follow the onscreen instructions and tap Submit to save your bank account. To withdraw the fiat borrowed funds from your YouHodler account using a bank wire, go to your Wallets and press the Withdraw button on the fiat wallet panel. Note that you have to connect your bank account to your Zengo wallet prior to requesting a fiat withdrawal and that it may take a few days for your funds to. Once your bank account is linked, select the “Deposit” option within your Fiat Wallet. Step 2: Enter Deposit Amount: Specify the amount you wish. Wait for the fiat partner to transfer money into your bank account. When you receive money, click on [I have received payment] to release NGNR for the fiat.

To withdraw to a cryptocurrency address, simply: · 1. Open your Skrill account · 2. Click 'Withdraw' and then 'Crypto Wallet' · 3. Enter the amount you want to. Click "Deposit" next to the fiat currency balance. · Follow the instructions on the screen, including Coinbase's bank details. · Use the details. Crypto payment solutions that provides ultra-fast payments between Crypto and Banks. Use crypto to transfer money, pay bills and invoices. (SEPA) Add cash to your local currency balance via SEPA transfer. (SEPA) Make sure the bank account receiving the SEPA transfer is denominated in EUR. Within your fiat wallet, look for an option that allows you to withdraw funds or transfer money to an external bank account. This option may be. Yes, you sure can. Tap Transfer then Withdraw. If you can't see the option there, go into Accounts > Fiat wallet and follow the same steps. Edit bank account · On your dashboard, click on Portfolio · Click on Currencies · Select the fiat wallet you wish to withdraw from · Click on Withdraw · Click on the. Users also have the option to transfer funds from their fiat wallet directly to their bank account, simply select this option from the fiat currency you have. You can sell crypto for fiat currency (cash) and withdraw crypto to your bank account or to a Visa debit card in Exodus Mobile, Exodus Desktop, and Exodus Web3. How you can withdraw Funds from your Rain Fiat Wallet? Withdrawing funds from your Rain fiat currency account and sending them to your personal bank account. Depositing Fiat · Click on the Deposit button on the navigation bar at the top of the page · Choose the right fiat wallet corresponding to the currency you wish. If you recently made a deposit with a Bank Transfer (ACH), the funds are pre-credited into your Gemini account so you can trade at our discretion but will not. Fiat wallets facilitate quick crypto investments by speeding up fund transfers. For example, if you were to transfer money directly from your bank to a. Edit bank account · On your dashboard, click on Portfolio · Click on Currencies · Select the fiat wallet you wish to withdraw from · Click on Withdraw · Click on the. Then, click on “Sell,” pick a crypto you want to withdraw and a fiat currency you wish to receive, then enter the amount before confirming. If the requested. Go to the Card page. · Tap on Top Up. · Select Fiat Wallet. · Input the top-up amount in USD. · Confirm the transaction (Rate will be held for 1. First what you will need to do is sign into the off-ramp exchange that you are most comfortable using. · 2. To set up your bank fiat click the accounts button. You can deposit funds with fiat currency by first linking your bank account. transfer, and location of the bank you're sending from. For USD, funds. You can sell crypto for fiat currency (cash) and withdraw crypto to your bank account or to a Visa debit card in Exodus Mobile, Exodus Desktop, and Exodus Web3. You can deposit funds with fiat currency by first linking your bank account. transfer, and location of the bank you're sending from. For USD, funds.

How Do I Download Videos On My Phone

Select the download icon next to the version you would like to save to your device. Screenshot at ttkarsenal.ru Can I download my videos in bulk? Save your recording straight to your computer. Please Note As of September , Loom videos can only be downloaded by admins and. This method implies if you are an Android/iOS user. You dont have to use any third party app to download Youtube videos. TubeMate doesn't download the original YouTube video, but rather a video encoded video by YouTube. Hence, the video sometimes fails to play, and downloading a. Easily download videos and music directly from the Internet onto your device. All formats are supported. % free! Video downloader auto detects videos. To download Prime Video titles, open the Prime Video app on your device, and find the title you want to download. Step-by-Step Guide: Downloading Videos on Android from the Internet · Step 1: Choose a Video Downloader App · Step 2: Install Your Chosen App · Step 3: Search For. You just need to access this utility through the default browser of your smartphone and enter the URL of the video you wish to download in the given field. The. Open the YouTube app on your device. · Look for the video you wish to download. · Tap the 3-dot button on the right side under the video's thumbnail. · Click. Select the download icon next to the version you would like to save to your device. Screenshot at ttkarsenal.ru Can I download my videos in bulk? Save your recording straight to your computer. Please Note As of September , Loom videos can only be downloaded by admins and. This method implies if you are an Android/iOS user. You dont have to use any third party app to download Youtube videos. TubeMate doesn't download the original YouTube video, but rather a video encoded video by YouTube. Hence, the video sometimes fails to play, and downloading a. Easily download videos and music directly from the Internet onto your device. All formats are supported. % free! Video downloader auto detects videos. To download Prime Video titles, open the Prime Video app on your device, and find the title you want to download. Step-by-Step Guide: Downloading Videos on Android from the Internet · Step 1: Choose a Video Downloader App · Step 2: Install Your Chosen App · Step 3: Search For. You just need to access this utility through the default browser of your smartphone and enter the URL of the video you wish to download in the given field. The. Open the YouTube app on your device. · Look for the video you wish to download. · Tap the 3-dot button on the right side under the video's thumbnail. · Click.

To download a video/image, open the file on the player page, then tap the file to reveal the three dots (menu). Select Save to Camera Roll and then choose. You can do this through a couple ways, the first being the headset/mobile app and the next being the PC app. I can't download or watch my oculus videos. How. You can import photos and videos you have stored on a camera's SD card, a USB drive, a phone, or on another device. Here's how. Use a file management app like Documents by readdle or Es file explorer. They have a browser built in the app so you can download files properly. My dear! · There are a few ways to download a YouTube video on a phone. · One way is to use a third-party app. There are many different apps. Video downloader is a super fast downloader, completely free, download videos by one click in built-in browser. Simple operation can help you download videos. For example, InsTube – Free Video and Music Downloader for Android can be found only at InsTube's website. Download the APK (Android application package) file. How to download Facebook videos on most Android phones and tablets · Launch Facebook on your Android phone. · Open a video and tap the three-dot menu in the upper. Save a photo or video to your camera roll · Open the Google Drive app. · Next to to file you want to download, tap More (three dots). · Tap Send a copy. · Depending. Download a single picture or video, download up to selected pictures or videos using Google Photos, download albums using Google Photos, download using. 1. How can I download YouTube videos to my gallery? To save YouTube videos to your phone's gallery, utilize the offline viewing option provided by YouTube. Open the Files or My Files app from the home screen or app drawer. Look for a section called Downloads. Tap it to view the files you downloaded. Here are the ways to save photos: From the Inbox Simply click on any image you like to enter full-screen mode and click the download button on the left. Can my viewers download my video? If you have a paid workspace role(creator Mobile Apps. Resources. Blog · Help & Support · Community · eBooks · Status. Whatever device you use, there are three most straightforward ways to download Instagram videos in the phone gallery. Can I Download It from My Private. How to Download YouTube Videos on Android ; 1. Install and launch 4K Video Downloader for Android. ; 2. Open the YouTube video you want to download. ; 3. Tap the. A Ring Video Doorbell owner applying settings to their Ring account in the Ring app. You can download one video at a time from the Ring app, or download up to. Downloading content · For movies, press the Download Download Icon button from the Details page · For TV shows, select the Episodes tab to find downloadable. How can I see what videos are downloaded on my device? Click the "Playlists" tab. Click "Saved for Offline." Choose to “See All,” or just what's already. My Downloader English. My Downloader Download videos from Share videos from the Reddit app and download to your phone. free English

When Do You Need To Refinance Your Home

When you refinance, you are applying for a new mortgage to replace your current one, which will result in a new rate, term and monthly payment. Maybe you want to lower your monthly payment, change the loan term, get a lower interest rate, or tap into your home equity for other expenses. The answer is you should wait until the math actually works over the life of your current loan vs. the new loan you'd be accepting. The examples. The general rule is that if you are planning on staying in your home for longer than the break-even point, it's a good idea to refinance. 1. Mortgage interest rates are falling · 2. You got married · 3. Home values are increasing · 4. You came into an inheritance or other windfall · 5. Your credit. Refinancing your mortgage in simple terms is when you get a new loan for your existing home, and pay off your first loan. In addition to an adequate credit score, you must have built up enough equity in your home to qualify for a refinance. Home equity is the percentage of the. This guide explains when it's ideal to refinance your mortgage. It also discusses circumstances when holding off may be a more sound idea. However, a good rule of thumb is to consider refinancing when the current interest rate is approximately one percent below your current rate. Reducing your rate. When you refinance, you are applying for a new mortgage to replace your current one, which will result in a new rate, term and monthly payment. Maybe you want to lower your monthly payment, change the loan term, get a lower interest rate, or tap into your home equity for other expenses. The answer is you should wait until the math actually works over the life of your current loan vs. the new loan you'd be accepting. The examples. The general rule is that if you are planning on staying in your home for longer than the break-even point, it's a good idea to refinance. 1. Mortgage interest rates are falling · 2. You got married · 3. Home values are increasing · 4. You came into an inheritance or other windfall · 5. Your credit. Refinancing your mortgage in simple terms is when you get a new loan for your existing home, and pay off your first loan. In addition to an adequate credit score, you must have built up enough equity in your home to qualify for a refinance. Home equity is the percentage of the. This guide explains when it's ideal to refinance your mortgage. It also discusses circumstances when holding off may be a more sound idea. However, a good rule of thumb is to consider refinancing when the current interest rate is approximately one percent below your current rate. Reducing your rate.

Generally, a mortgage refinance is a good idea if it will save you money. Mortgage experts say you should consider this move if you can lower your interest. You often need to wait six months before you refinance a Conventional loan. In some states, you may have to wait more than six months. The seasoning period for. What Do I Need to Refinance? · Proof of income: paystubs, two years of tax returns, W-2/ forms · Proof of assets: home ownership documents and current home. Mortgage refinances can help homeowners save money by lowering their monthly housing cost, or by reducing their interest rates and improving the terms of their. Refinancing early and often is not good advice. A mortgage is an amortization loan and most of the interest is paid up front. In some situations. 1. Mortgage interest rates are falling · 2. You got married · 3. Home values are increasing · 4. You came into an inheritance or other windfall · 5. Your credit. Homeowners who have less than 20% equity in their home when they refinance will be required to pay private mortgage insurance (PMI). If you are already paying. What Documents Do You Need to Refinance Your Mortgage? A Checklist · Proof of income · Insurance information · Credit verification · Statements of debt. Should You Pay Off Your Mortgage or Refinance? A good mortgage rule of thumb is to refinance if rates are around one half percent less than your current rate. The more money you put into your home, the easier it will be to refinance, regardless of when you do it. Ideally, you should pay at least 20% of the home's. Whether or not you should refinance depends on your specific circumstances. Refinancing at the right time can help you save money, either by lowering your. Whether or not you should refinance depends on your specific circumstances. Refinancing at the right time can help you save money, either by lowering your. You should only consider refinancing when interest rates are lower than you're now paying. That's because the interest rate on a home mortgage is connected to. A mortgage refinance can save you thousands of dollars over the life of your loan, allowing you to keep more money in your pocket every month. Whether you're. The most immediate benefit of refinancing is that it helps cash-strapped borrowers find space within their monthly budget. This could be advantageous if you. Lower your monthly mortgage payment by lowering your interest rate · Help you pay down your mortgage faster · Eliminate the cost of mortgage insurance (PMI) if. If you have available home equity, you could get cash when you close your refinance loan You should check your settings for accuracy based on your. Or to leverage the equity they already have. When you refinance a year loan to a year loan, you'll build equity twice as fast. This refinance strategy. Increased home equity also means you have the option of considering a cash-out refinance. A cash-out refinance could be helpful to cover emergency repairs.

Historical Chart

United States DollarQuote - Chart - Historical Data - News · Markets. Currency · Government Bond 10Y · GDP. Full Year GDP Growth · GDP · Money. Banks Balance. WordPress plugin and widget for displaying stock market live charts and technical indicators. Historically, the United States Stock Market Index reached an all time high of in July of United States Stock Market Index - data, forecasts. Discover real-time NASDAQ Composite Index (COMP) share prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Data · DOL Enforcement Database · Workers Owed Wages · Order Publications History of Federal Minimum Wage Rates Under the Fair Labor Standards Act, MSFT - Microsoft Corp. Historical Chart, Quote and financial news from the leading provider and award-winning ttkarsenal.ru View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Discover historical prices for SPY stock on Yahoo Finance. View daily, weekly or monthly format back to when SPDR S&P ETF Trust stock was issued. Dow Jones Industrial Average | historical charts for DJIA to see performance over time with comparisons to other stock exchanges. United States DollarQuote - Chart - Historical Data - News · Markets. Currency · Government Bond 10Y · GDP. Full Year GDP Growth · GDP · Money. Banks Balance. WordPress plugin and widget for displaying stock market live charts and technical indicators. Historically, the United States Stock Market Index reached an all time high of in July of United States Stock Market Index - data, forecasts. Discover real-time NASDAQ Composite Index (COMP) share prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Data · DOL Enforcement Database · Workers Owed Wages · Order Publications History of Federal Minimum Wage Rates Under the Fair Labor Standards Act, MSFT - Microsoft Corp. Historical Chart, Quote and financial news from the leading provider and award-winning ttkarsenal.ru View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Discover historical prices for SPY stock on Yahoo Finance. View daily, weekly or monthly format back to when SPDR S&P ETF Trust stock was issued. Dow Jones Industrial Average | historical charts for DJIA to see performance over time with comparisons to other stock exchanges.

Move your mouse pointer over a bar on the chart to display the stock price and its effective date. The historical stock price information is provided for. Units: Percent, Not Seasonally Adjusted. Frequency: Monthly. Notes: Averages of daily figures. For additional historical federal funds rate data. Historical Prime Rate. Effective Date, Rate. 7/27/, %. 5/4/ These cookies may collect personal data such as your name as well as. Historical Union Membership Tables. Access to Historical Data Series by Subject: Previous years and months. Browse labor force, employment, unemployment, and. Discover historical prices for ^GSPC stock on Yahoo Finance. View daily, weekly or monthly format back to when S&P stock was issued. Discover real-time NASDAQ Composite Index (COMP) share prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Historical summary of the U.S. government's total outstanding debt at the beginning of each fiscal year. Historical Charts: The Coolest Annotated Chart Section In The World · Historical Chart: Gold Price. The first set of historical charts are the gold charts. Chart|Historical Search. Export To:Excel|XML. DATE, RATE (%), 1ST PERCENTILE Reference Rates Historical Data Search. Note: Starting with the March 1. Interactive chart of historical data for real (inflation-adjusted) gold prices per ounce back to The series is deflated using the headline Consumer Price. USD to EUR currency chart. XE's free live currency conversion chart for US Dollar to Euro allows you to pair exchange rate history for up to 10 years. Consumer Price Index Historical Tables for U.S. City Average. CONSUMER Telephone: DATA (or ) ttkarsenal.ru Contact. The LBMA Gold Price is used as an important benchmark throughout the gold market, while the other regional gold prices are important to local markets. This data. Climate Data Online (CDO) provides free access to NCDC's archive of global historical weather and climate data in addition to station history information. Historical Returns on Stocks, Bonds and Bills: Data Used: Multiple data services. Data: Historical Returns for the US. Date: January Download. Return to Electricity Below is a graph depicting historical AES Ohio's "Price to Compare" (PTC) rates. To compare rates available today from PUCO-certified. Basic Chart Advanced Chart. Home · Quotes · News · Industries · Markets · Historical Quotes. MarketWatch Search. IndexWatch. Major market indexes» · Refresh |. Create a free chart for any currency pair in the world to see their currency history for up to 10 years. These currency charts use live mid-market rates. The latest BLS data, covering up to July, was released on August 14, The next inflation update is scheduled for September 11, and it will provide.

Kakao Banking

Whether it's opening accounts, applying for loans, overseas remittance, or issuing certificates, try using KakaoBank Mobile App for banking services whenever. Kakao Bank launched a Self-camera (selfie) one-time password (OTP) service which allows users to authenticate themselves by simply taking a selfie without. In building Korea's first mobile-only bank, kakaobank questioned the purpose of a banking business and created a people-first proposition. South Korea's KakaoBank Corp. announced on Tuesday its decision to invest in Indonesia's digital banking entity PT Super Bank ttkarsenal.ru move Oct Kakao Bank. The Latest. July 26, Kakao gets nod to raise stake in m-banking-ss. Mobile World Live Logo. Be the first to know. Subscribe to our. Fairly unknown to most in the west, South Korean conglomerate, kakao Corp., launched its online bank, kakaobank, on 27 July Banking in one cacao bank app Deposit, savings, loan, overseas remittance, check card, meeting passbook, my credit information. Kakao Bank has adopted an ecosystem approach that goes beyond traditional financial services. This strategy leverages technology and partnerships to create a. Only Korean citizens can open Kakao Bank accounts. Foreigners can't - it's on Kakao Bank's FAQ section on their website. 외국인은 계좌개설을. Whether it's opening accounts, applying for loans, overseas remittance, or issuing certificates, try using KakaoBank Mobile App for banking services whenever. Kakao Bank launched a Self-camera (selfie) one-time password (OTP) service which allows users to authenticate themselves by simply taking a selfie without. In building Korea's first mobile-only bank, kakaobank questioned the purpose of a banking business and created a people-first proposition. South Korea's KakaoBank Corp. announced on Tuesday its decision to invest in Indonesia's digital banking entity PT Super Bank ttkarsenal.ru move Oct Kakao Bank. The Latest. July 26, Kakao gets nod to raise stake in m-banking-ss. Mobile World Live Logo. Be the first to know. Subscribe to our. Fairly unknown to most in the west, South Korean conglomerate, kakao Corp., launched its online bank, kakaobank, on 27 July Banking in one cacao bank app Deposit, savings, loan, overseas remittance, check card, meeting passbook, my credit information. Kakao Bank has adopted an ecosystem approach that goes beyond traditional financial services. This strategy leverages technology and partnerships to create a. Only Korean citizens can open Kakao Bank accounts. Foreigners can't - it's on Kakao Bank's FAQ section on their website. 외국인은 계좌개설을.

KakaoBank Corp., an Internet bank, provides banking services through electronic financial transaction method in South Korea. It offers various deposits. Kakaobank offers digital banking, loans, and financial services. Kakao Bank believes that meeting between people and banks should be easier and more frequent. – Founding of Kakao Corp. · – Merger of Daum and Kakao · –present: New business model. Internet bank; Transportation. The FSC granted preliminary approval on November 29 to two consortiums – one led by Kakao and the other by KT Corp. – out of three bidders to set up internet-. This article dives deep into Kakao bank's business model, identifying its key challenges and solutions along with its technology and partnership strategies. financial value except for its features. When the Member withdraws from Kakao Account, the digital card issued under the Kakao account will be deleted, and. New Loans by KakaoBank. Banking sector M/S. (Wbn). KakaoBank Mortgage Loan and M/S. Mortgage loan market. Covered. 32%. Uncovered. 68%. Mortgage Loan. Core services include big data-based mid-interest rate loans, KakaoTalk- based easy remittance, KakaoTalk- based financial assistant, and simple payment. South Korea's KakaoBank Corp. announced on Tuesday its decision to invest in Indonesia's digital banking entity PT Super Bank ttkarsenal.ru move Oct KakaoBank Corp (KakaoBank) is a provider of digital banking solutions. The company's offering products include deposits, checking accounts, group accounts. 82 2 ttkarsenal.ru Sector: Financial Services. Industry: Banks - Regional. Description. KakaoBank Corp., an Internet bank, provides banking. Send money anytime, anywhere, buy what you need on the spot, and use a barcode to pile up rewards with Kakao Pay. A new bank should save customers' time, assist them in raising funds quickly and at a low cost, and provide an easy and enjoyable saving experience. Kakao Bank of Korea(한국카카오은행, aka 카카오뱅크) is a Korean branchless bank run by Kakao Corp, one of the popular portal website service providers in South. Discover how an EY team worked with Kakao to create South Korea's first digital-only bank, changing the future of banking consumers everywhere. KakaoBank. Seongnam, South Korea. FORBES PROFILES. Capitalize on your Related by Industry: Banking. View Profile · South Korea. Located in. Integrating with Kakao Pay enables South Korea-based customers to pay using this popular local payment method. See our website to know more about Kakao Bank Friends Check Card from Kakao Bank of Korea. KakaoBank Corp. operates bank businesses. The Company provides deposit money, withdraw money, credit cards, stock accounts, linked loans, and other services. Received full banking license. JanuaryEstablished Korea Kakao Corp. (to-be KakaoBank). NovemberPreliminary accreditation for banking. Brand Video.

Tax Free Withdrawal From Roth Ira

As the name suggests, the five-year rule requires you to satisfy a five-year holding period before you can withdraw Roth IRA earnings tax-free or converted. According to the IRS, to discourage the use of IRA distributions for purposes other than retirement, you'll be assessed a 10% additional tax on early. Guidelines for withdrawals. Withdrawals before age 59½. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. It's Never Too Late to Start Saving With a Roth IRA Did you know a Roth IRA offers tax-free earnings and withdrawal flexibility? If you're 59 ½ and the money. You can withdraw up to the total amount of your direct contributions at any age without tax or penalty. Age of the account doesn't matter either. Roth Individual Retirement Accounts (IRAs) are a good choice if you're seeking tax-free withdrawals in retirement, want to avoid taking required minimum. A Roth IRA allows you to withdraw your contributions at any time—for any reason—without penalty or taxes. For example: If you contributed $12, over 2 years. Employees may withdraw funds from the URS Roth IRA at any time. Earnings may be withdrawn tax-free if the employee is over age 59½ and if any Roth IRA has been. Roth IRA withdrawal rules: When are withdrawals tax free? · You're age 59 1/2 or older when you withdraw the money · You used the money for a first-time home. As the name suggests, the five-year rule requires you to satisfy a five-year holding period before you can withdraw Roth IRA earnings tax-free or converted. According to the IRS, to discourage the use of IRA distributions for purposes other than retirement, you'll be assessed a 10% additional tax on early. Guidelines for withdrawals. Withdrawals before age 59½. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. It's Never Too Late to Start Saving With a Roth IRA Did you know a Roth IRA offers tax-free earnings and withdrawal flexibility? If you're 59 ½ and the money. You can withdraw up to the total amount of your direct contributions at any age without tax or penalty. Age of the account doesn't matter either. Roth Individual Retirement Accounts (IRAs) are a good choice if you're seeking tax-free withdrawals in retirement, want to avoid taking required minimum. A Roth IRA allows you to withdraw your contributions at any time—for any reason—without penalty or taxes. For example: If you contributed $12, over 2 years. Employees may withdraw funds from the URS Roth IRA at any time. Earnings may be withdrawn tax-free if the employee is over age 59½ and if any Roth IRA has been. Roth IRA withdrawal rules: When are withdrawals tax free? · You're age 59 1/2 or older when you withdraw the money · You used the money for a first-time home.

There are no tax implications on your contributions, as contributions can always be withdrawn tax free. Although the 5-year rule is met, the. They say that you can withdraw early from a Roth IRA penalty free if it is for an exception (house purchase, birth of a child), but the article. When you start withdrawing from your account at retirement age, you will pay taxes on the funds you take out. With a Roth IRA, you contribute to your IRA after. Direct contributions can be withdrawn tax-free and penalty-free anytime. · Concerning Roth IRAs five years or older, tax-free and penalty-free withdrawal on. Qualified distributions are tax-free and penalty-free. A Roth IRA distribution is considered qualified if your account meets the five-year rule and the. With a Roth IRA, contributions are made with after-tax dollars and are not tax-deductible. Distributions from Roth IRAs are free of federal taxes and may be. *You must meet minimum qualifications to withdraw your Roth funds tax-free. These include a five-year holding period from the year of your first contribution. You can withdraw your contributions at any time and any potential earnings can be withdrawn tax-free1 in retirement. You aren't required to take distributions. At retirement, the distributions will be tax-free. The Traditional IRA saver will pay taxes when they take distributions, but because they are not paying taxes. Contributions can be withdrawn anytime without taxes or penalties. Withdrawals of earnings are tax-free if you're at least age 59 ½ and made your first. Certain distributions from Roth IRAs are not taxable. Can I deduct the 10% additional early withdrawal tax as a penalty on early withdrawal of savings? No. In general, with Roth accounts you will have already paid taxes before you contribute money to your account so you can withdraw money tax-free as long as you. With a Roth IRA, every penny you withdraw in retirement goes into your pocket, tax-free. tax-deductible for federal income tax purposes, and there is no age limit for making contribu- tions. Generally, Roth IRA withdrawals are not taxable for. Taxes. Unlike a traditional IRA, you cannot deduct contributions to a Roth IRA. But, if you satisfy the requirements, a Qualified Distribution is tax free. A. If you're at least age 59½ and your Roth IRA has been open for at least five years, you can withdraw money tax- and penalty-free. See Roth IRA withdrawal rules. Contributions can be withdrawn anytime without taxes or penalties. Withdrawals of earnings are tax-free if you're at least age 59 ½ and made your first. If you qualify to convert an existing IRA to a Roth IRA for federal tax purposes, you also qualify for. New Jersey tax purposes, even if your New Jersey taxable. Contributions are withdrawn first and are always tax- and penalty-free. You will, however, be required to pay taxes on any withdrawn earnings. Will the 10% tax. At retirement, the distributions will be tax-free. The Traditional IRA saver will pay taxes when they take distributions, but because they are not paying taxes.

Can You Sell Your House Before Paying Off The Mortgage

The property market is dynamic, and while you may be selling your house before the mortgage is paid off, it's possible that you owe more on your property than. It is important to communicate with your lender throughout the process for several reasons: Paying off the mortgage: When you sell your home, the proceeds from. Yes, you can sell your house even if you haven't yet paid off the mortgage. In fact, many choose to relocate before paying their mortgage in full. The most common scenario with sellers is that their mortgage is repaid in full from the sale of their property. As long as the sale price covers the amount. If you cannot make up all of your missed payments in one lump sum or negotiate with your lender to allow you to keep your house, selling your home might be an. So without a doubt, it's certainly possible to sell a house before paying off what you owe to a lender. Before you go on this path, take note of some key. Though it isn't necessary to pay off a mortgage before you sell your house, it may be a viable option depending on your situation. This option requires some. It depends. Here are two circumstances in which Dave says it makes sense to sell your home to pay off debt. Reason #1: Your Mortgage Payment Is Way. So, if you have a mortgage payment while house selling, the lender will want to collect the rest of what you owe right away. So how does the lender receive the. The property market is dynamic, and while you may be selling your house before the mortgage is paid off, it's possible that you owe more on your property than. It is important to communicate with your lender throughout the process for several reasons: Paying off the mortgage: When you sell your home, the proceeds from. Yes, you can sell your house even if you haven't yet paid off the mortgage. In fact, many choose to relocate before paying their mortgage in full. The most common scenario with sellers is that their mortgage is repaid in full from the sale of their property. As long as the sale price covers the amount. If you cannot make up all of your missed payments in one lump sum or negotiate with your lender to allow you to keep your house, selling your home might be an. So without a doubt, it's certainly possible to sell a house before paying off what you owe to a lender. Before you go on this path, take note of some key. Though it isn't necessary to pay off a mortgage before you sell your house, it may be a viable option depending on your situation. This option requires some. It depends. Here are two circumstances in which Dave says it makes sense to sell your home to pay off debt. Reason #1: Your Mortgage Payment Is Way. So, if you have a mortgage payment while house selling, the lender will want to collect the rest of what you owe right away. So how does the lender receive the.

If you have an open mortgage, you can sell your home without paying penalties for breaking the mortgage contract. However, if you have a closed mortgage, there. Depending on the lender's loan terms, you could be charged prepayment penalty fees and other fees for paying off and closing the loan before the end of the. Because of how interest-only mortgages operate, you will be expected to use the proceeds from selling your home pay off the entire loan at once, and this could. When Can Selling a House to Pay Off Debts be a Smart Decision · You can't afford your mortgage payments and refinancing is not an option. · You need to pay off. You can sell your house without completely paying off your mortgage. · To begin the process of selling your home, request a payoff statement and calculate the. In other words, the buyer is not assuming your loan; he or she is simply continuing to pay down your mortgage just as you would. The only difference is the new. The bank might not give you the permission for the sale. This depends on the actual circumstances. If the remaining loan is not too high, banks might give you. It often makes sense to sell your current home before buying your next home. Most homeowners need the equity from their current home to make a down payment. The good news is that selling your house before the end of the mortgage term is entirely possible. As long as you can afford to pay off the remaining balance. Some home equity loans have early repayment penalties that will apply if you sell your house to pay off the loan. Make sure you contact your lender before you. If you're considering selling your home, you're likely wondering, “Can I move before my mortgage is paid off?” Not only is the answer, yes, but you can buy. The property market is dynamic, and while you may be selling your house before the mortgage is paid off, it's possible that you owe more on your property than. In general, we recommend sellers make the final payment 7 days before closing. But don't sweat it, if you overpay, lenders are r. Can I Sell a House Before Paying Off My Mortgage? Yes, it's a standard procedure to pay off your mortgage when you sell your house. The funds from the sale. You may be able to earn money to cover your soon-to-be mortgage payment by offering the existing occupants extra time to stay while you sell your property. “. A: Yes, you can sell your house before paying off the entire mortgage. The proceeds from the sale will go towards paying off the remaining balance of your. But if you paid-off your loan, then you only need (property tax* + maintenance). You do not need 3 to 6 months of mortgage amount sitting in your emergency fund. When you sell a home, you will also have to pay interest on your outstanding mortgage balance from the date of your last payment until the time of the sale. You. While selling a home within a year of purchase isn't ideal, you can technically sell your home any time after closing. Banks have created a loan product called a bridge loan (also called swing loans or gap financing) for people who want to buy a new home before selling the old.